Meta Investments News (November 2022)

Meta Investments News is a monthly newsletter sent to our investors and supporters.

Top News/Articles for November 2022

November Cryptocurrency Market Update.

(Discussed Below)Enron.FTX.

(Discussed Below)Bill Ackman on Crypto.

(Discussed Below)NFTs… Are Embraced by Some Museums.

ICA Miami became one of the first museums to collect NFTs.

“Our collection, as well as our exhibitions and programs, seek to take on some of the most pressing and topical art and ideas that are happening today.”

“Over the last two or three years, one of the most ubiquitous and transformative conversations has been around how artists explore and develop their creativity through NFTs.”

Other museums are also acquiring NFTs.

Uffizi Galleries in Florence, Italy, and the British Museum, are minting and selling them from works in their collections. And artists are being encouraged in their efforts to produce digital art.

Encryption on the blockchain is said to make a digital work impossible to fake.

Each unique work, or edition, has information about its provenance and past ownership that is permanently recorded on the blockchain.

The digital art world is now attracting prominent international curators, such as Daniel Birnbaum, who previously led Stockholm’s Moderna Museet and was the artistic director of the Venice Art Biennale in 2009.

“Once or twice every century, something new arrives, like photography or cinema or television or the internet,”

“I think we’re in a moment of transformation, and it has to do with these new digital mediums.”

The NFT market “is still new, and the proverbial water has yet to find its level,” he said. “I don’t think it’s going away, and I think it will only continue to grow.”

“Museums tend to collect what has turned out to be important and influential,” he said. “I’m pretty sure that they will collect digital art in the future. It’s already happening.”

Texas Work Group on Blockchain Matters Report.

Texas Work Group on Blockchain Matters released its 2022 Legislative Report and Master Plan.

Membership of the group includes representatives from state agencies, universities in Texas, and private industry.

Report examines current blockchain industry in Texas, reviews the state’s current academic, educational, and workforce needs required to grow the industry, and identifies areas for economic growth and development opportunities presented by blockchain technology.

Affirm the importance of exploring a framework for self-sovereign identity (“SSI”) that would allow individuals to custody data about themselves and decide when, how, and with whom that data is shared.

Legislature should adopt a resolution supporting educational initiatives related to blockchain technology.

Incentivize controllable loads like bitcoin mining by lessening the tax burden on the purchase of electricity when it is used to power a bitcoin mine or other large flexible load.

Codifying established cryptocurrencies with a large market cap, such as bitcoin, as an authorized investment for the State of Texas.

Calls attention to the potential dangers of the creation of a retail Central Bank Digital Currency (“CBDC”) - e.g., a CBDC that involves a direct relationship between the Federal Reserve and consumers - in the United States, and encourages the Legislature to coordinate with the Texas Congressional Delegation to oppose such attempts.

Develop best practices or guidance related to finances and leveraging blockchain technology infrastructure.

e.g. defining blockchain benefits, use cases, contractual language, develop blockchain innovation and/or center of excellence, and education or curriculum development.

Brazil's Congress Moves to Regulate Crypto Payments.

Brazil has made considerable progress in terms of cryptocurrency regulation and adoption among investors and is currently the country with the most cryptocurrency ETFs in Latin America.

Brazil's Chamber of Deputies approved a new regulatory framework that will include digital currencies.

Banks could soon begin offering crypto payment services, facilitating the use of crypto for buying and selling ordinary goods, in the same way that consumers currently use credit cards or other similar services.

Some banks in Brazil are already experimenting with crypto custody while one of Brazil's largest private banks (Itaú), plans to launch its own asset tokenization platform.

One of the most important aspects of the regulation is the obligation for service providers to separate their funds from those of their clients as a way to prevent a situation similar to that of FTX.

What We’re Listening To

New York Times Daily: The Man Who Was Supposed to Save Crypto. The Spectacular Rise and Fall of Sam Bankman-Friend and FTX.

Acquired: The Complete History & Strategy of Enron.

What Bitcoin Did with Jesse Powell (Founder / CEO of Kraken exchange): The FTX Contagion.

Empire: Distressed Crypto Investing - Buying Claims for Cents on the Dollar.

What We’re Watching

Sam Bankman-Fried (FTX CEO) Entire Testimony to Congress in December 2021.

November Cryptocurrency Market Update.

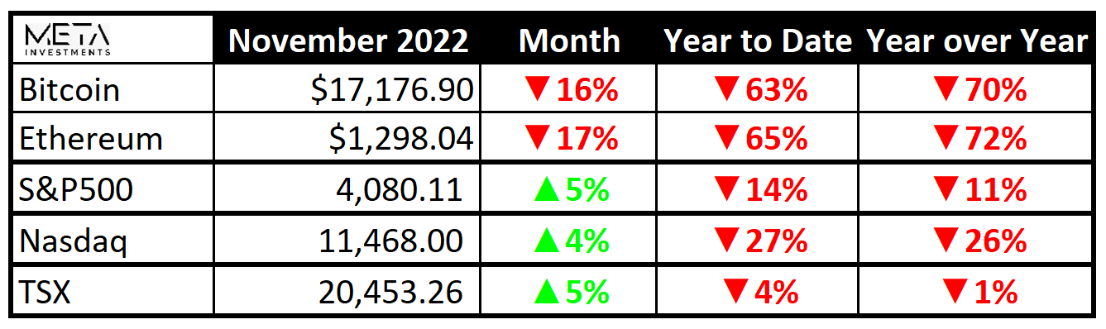

Amounts in the chart reflect end of month values and ignores (wild) swings within the month.

Bitcoin and Ethereum reached their monthly high in early November (pre-FTX fiasco):

BTC high of $21.3K on Nov. 5th

ETH high of $1.6K on Nov. 4th

Bitcoin and Ethereum subsequently crashed during peak FTX uncertainty:

BTC low of $15.8K on Nov. 9th (down 26%)

ETH high of $1.1K on Nov. 9th (down 34%)

Click here for our special mid-month FTX update.

On the last day of November, Federal Reserve Chair Jerome Powell said he expects to slow rate hikes.

“It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,”

“The time for moderating the pace of rate increases may come as soon as the December meeting.”

The “Powell-Driven Stock Rally” led to large gains across equities. In fact, November 30th itself saw a number of tech companies experience material one-day moves:

Shopify = 10%

Netflix = 9%

Facebook = 8%

NVIDIA = 8%

Google = 6%

Microsoft = 6%

Apple = 5%

Bitcoin and Ethereum were also up 4% and 7%, respectively on November 30.

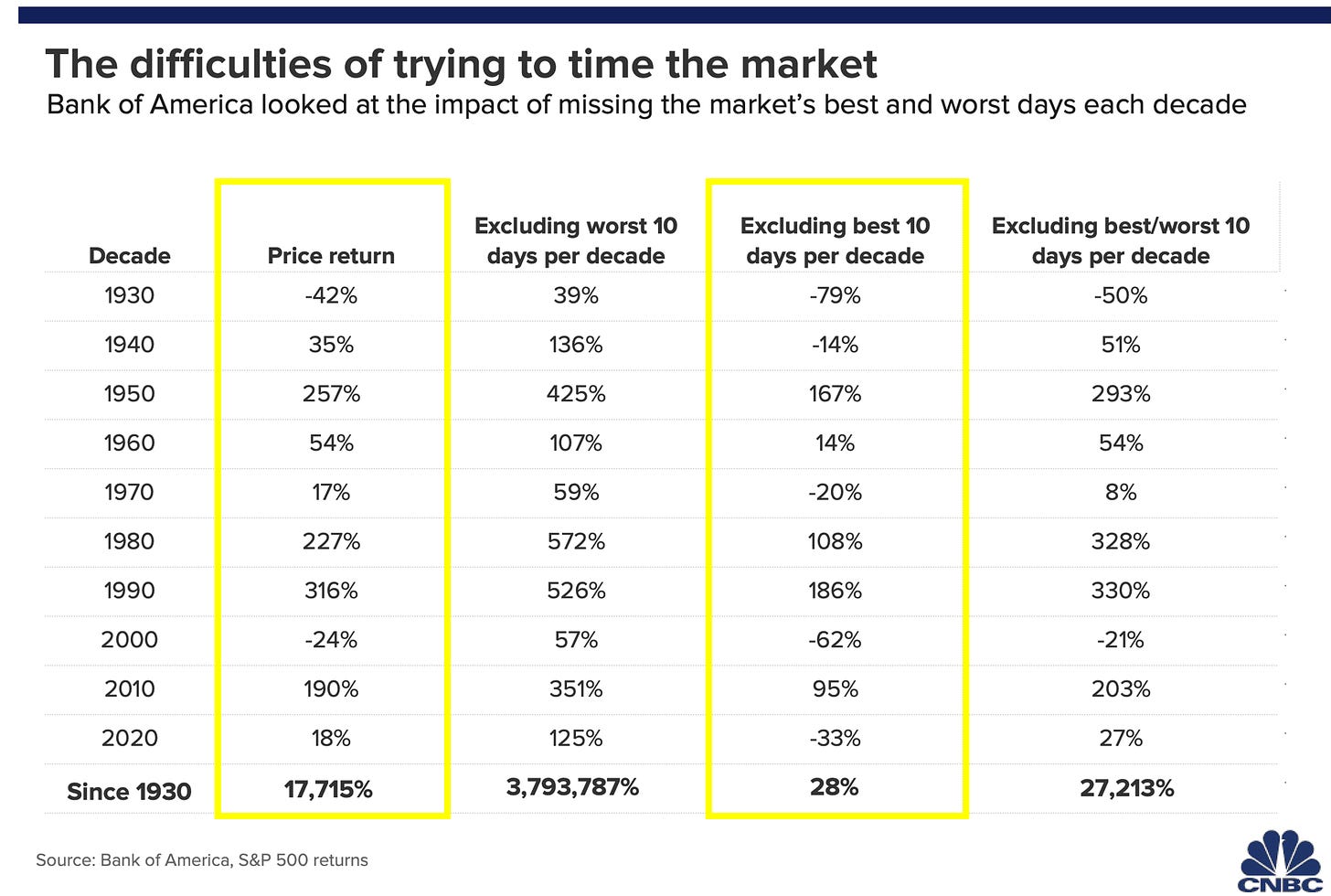

Timing the market is difficult at the best of times for even the most experienced traders and when stocks plunge - as they did in August and September - a natural impulse can be to hit the sell button.

Bank of America’s research reveals that the best market gains often follow the biggest drops, so panic selling can significantly lower returns for longer-term investors by causing them to miss the best days (summary of study).

Going back to 1930, if you held the S&P500 without selling then your return would be an impressive 17,715%.

On the other hand, if you panic sold during large drawdowns and cautiously sat on the sidelines waiting for the “right time” to get back in and subsequently missed the best 10 days in a given decade then your return for that entire period since 1930 would be a mere 28%… total.

Time in the market is better than timing the market.

The question most people ask is why did Powell offer an encouraging or “dovish” tone now?

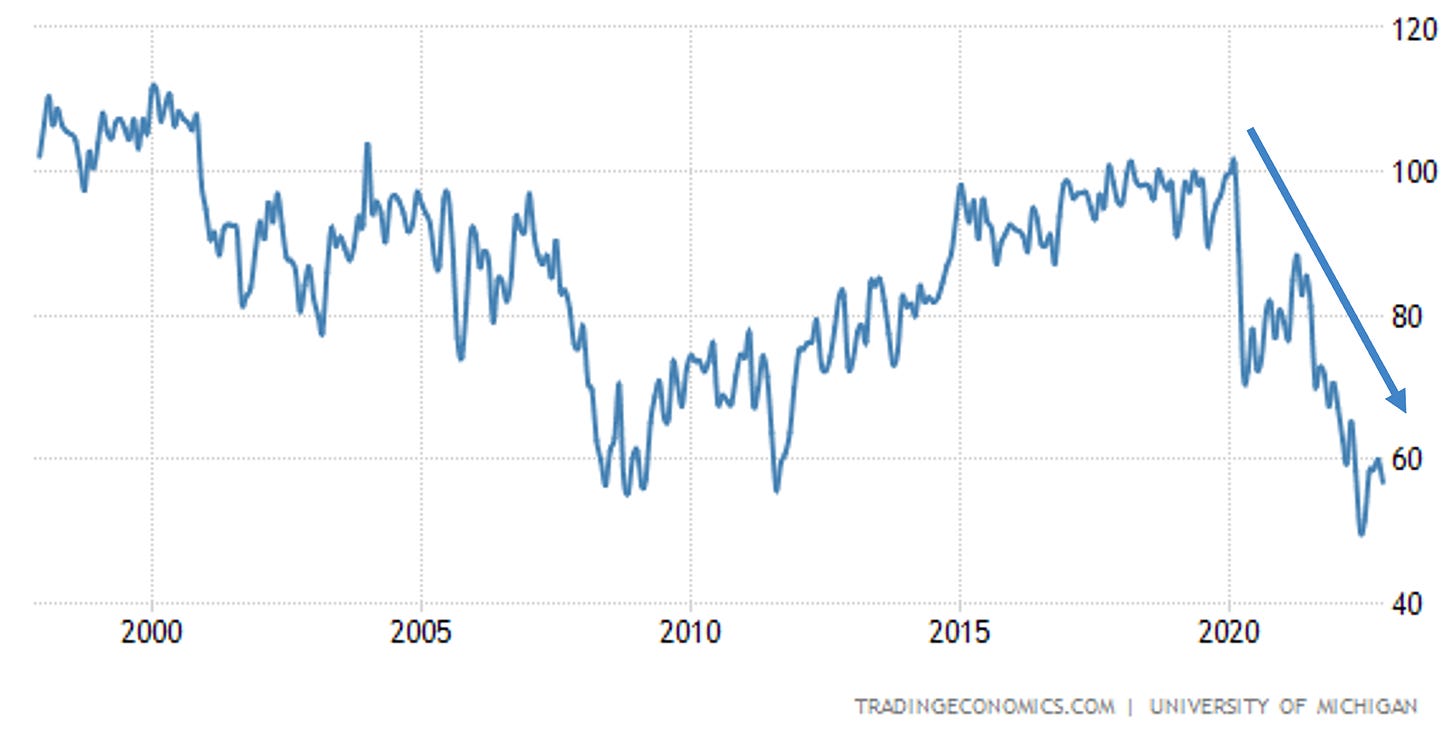

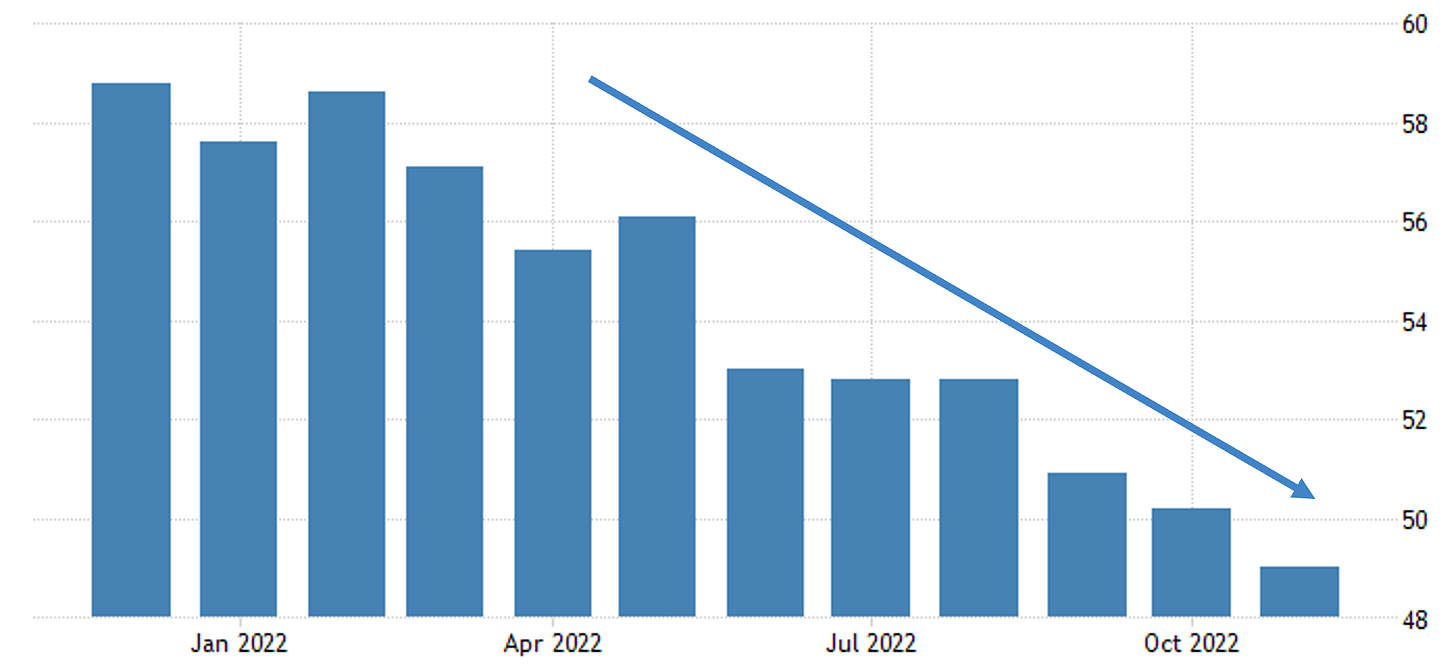

Powell’s remarks take into account the fact that inflation is “cooling”, consumer sentiment is low and manufacturing is in decline.

In other words, he’s forward looking and trying to encourage people, businesses and the overall economy.

Inflation for October cooled for a 4th straight month to 7.7% (below consensus forecasts of 8%), which was the second lowest reading of 2022.

In addition to cooling inflation, consumer and business sentiment remains near historic lows:

Consumer Confidence

Focused on three areas(i) how consumers view prospects for their own financial situation;

(ii) how consumers view prospects for the general economy over the near term; and

(iii) how consumers view prospects for the economy over the long term.

Along with the ongoing negative effects of inflation, attitudes have been impacted by rising borrowing costs, declining asset values, and weakening labor market expectations.

Purchasing Managers Index (PMI)

Declined to 49 in November of 2022 from 50.2 in October pointing to the first contraction in factory activity since May 2020.

A PMI reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally in decline.

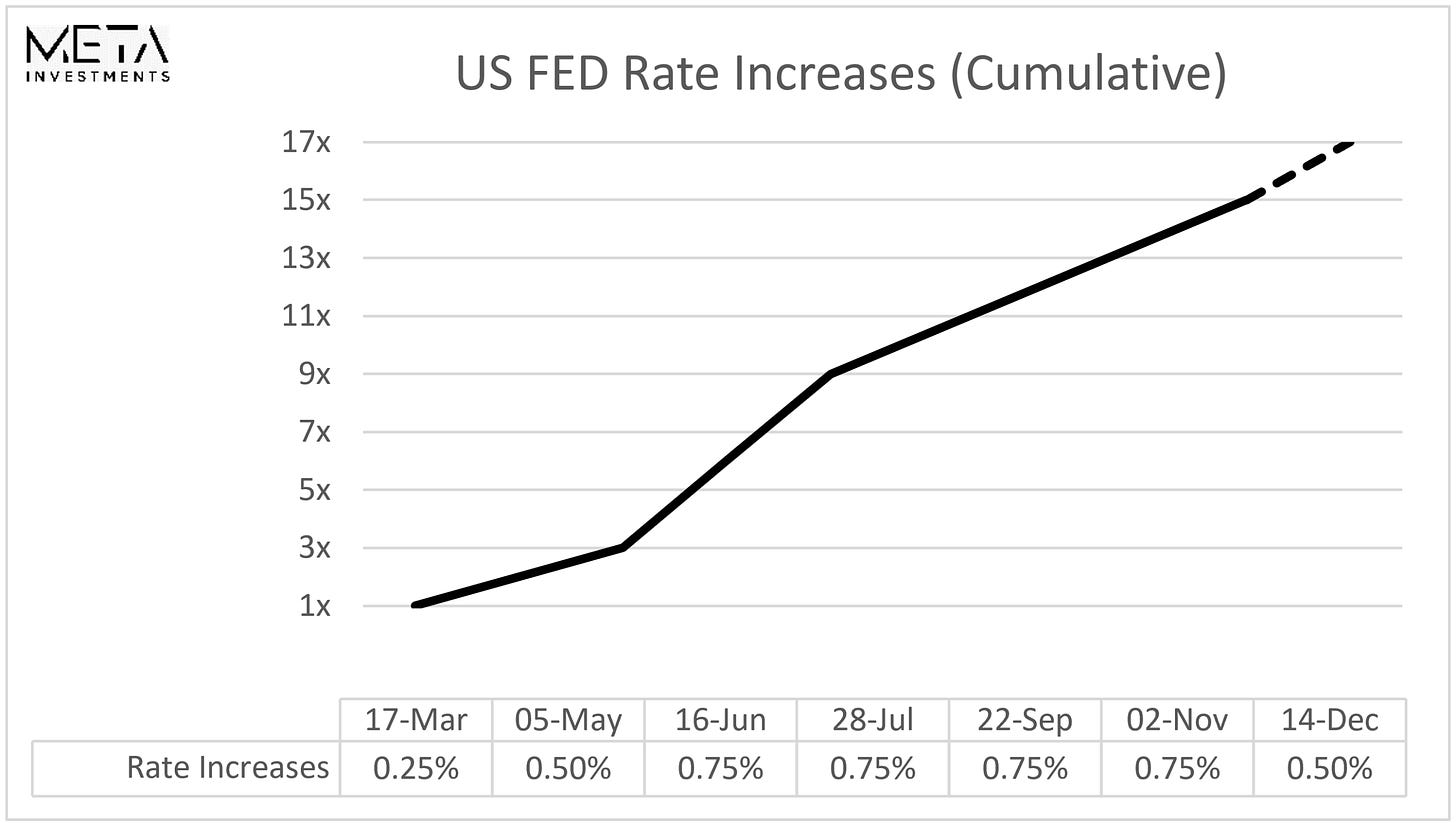

The current expectation is for interest rates to increase by another 0.5% in December, which would represent a 17x increase since March(!).

Despite short term movements in markets, we remain very bullish on the investment opportunity that blockchain technology and cryptocurrencies represent, especially at these depressed levels.

In terms of cryptocurrencies, Meta Investments is particularly focused on Bitcoin and Ethereum.

Enron. FTX.

“Ultimately, it is the story of the untold damage wreaked by a nation’s folly—a folly that, in time, we are all but certain to see again.”

- Conspiracy of Fools by Kurt Eichenwald, 2005.

There are more differences than similarities between Enron and FTX.

Enron was a public company focused on energy, commodities, and services based in the USA. It had a formal board of directors along with a reputable accounting firm (R.I.P. Arthur Anderson). At it’s peak, Enron was valued at ~$70 Billion = 7th largest public company!

FTX is was a private company focused on cryptocurrency exchange services and headquartered in the Bahamas. It did not have a formal board of directors nor a reputable accounting firm (First-Ever CPA Firm in the Metaverse). At it’s peak, FTX was valued at $32 Billion.

The following are a few interesting similarities we uncovered.

Similarity #1: John Ray III

John Ray III is administering the FTX’s bankruptcy.

John Ray III administered Enron’s bankruptcy.

Given his extensive experience, his First Day Pleadings filed with the U.S. bankruptcy court about FTX were revealing: “complete absence of trustworthy financial information.”

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,”

“From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

Similarity #2: Arm’s Length Trading

Internal assets for both Enron and FTX flowed between entities that were legally separate but in fact served the same masters.

FTX had an arm’s length relationship with a separately run trading fund: Alameda Research.

Blockchain analysis reveals that Alameda used the relationship to profit from trades by acquiring coins before their official listing and selling them immediately upon listing.

Enron had an arm’s length relationship with a separately run trading exchange: EnronOnline (“EOL”)

Enron was the counterparty to every transaction on EOL; it was either the buyer or the seller and received beneficial pricing.

Similarity #3: Ontario Teachers’ Pension Plan (“OTPP”)

OTPP invested approximately $100M into FTX.

OTPP invested hundreds of millions into a number of Enron entities.

Note: OTPP sold Enron stock before its collapse and generated a meaningful profit from the investment. Unfortunately, the same cannot be said for its investment in FTX.

Similarity #4: Connection to Professional Stadiums

FTX proudly renamed the Miami Heat basketball arena.

Enron proudly renamed the Houston Astros baseball field.

History may not repeat itself but it surely rhymes as revealed in the “rip-roaring narrative of epic proportions” about Enron from Conspiracy of Fools 15+ years ago.

This, then, is more than the tale of one company’s fall from grace. It is, at its base, the story of a wrenching period of economic and political tumult as revealed through a single corporate scandal. It is a portrait of an America in upheaval at the turn of the twenty-first century, a country torn between its worship of fast money and its zeal for truth, between greed and high-mindedness, between Wall Street and Main Street. Ultimately, it is the story of the untold damage wreaked by a nation’s folly—a folly that, in time, we are all but certain to see again.

- Conspiracy of Fools by Kurt Eichenwald, 2005.

Bill Ackman on Crypto.

Bill Ackman is an American billionaire investor and hedge fund manager.

He is the founder and CEO of Pershing Square Capital Management, a prominent hedge fund that has successfully run activist campaigns against McDonald's, Wendy's, and Herbalife.

He also made large - and very successful - investments in Target Corporation, General Growth Properties (becoming 2nd largest shareholder in Brookfield Asset Management), JC Penny, Pacific Railway, and more.

Most recently, Bill Ackman turned $27 million into $2.6 billion through defensive hedge bets when COVID started back in March 2020 (more info here).

Bill Ackman has an eye for value and a storied history of making big bets + securing big returns.

He recently took to Twitter to espouse the virtues and benefits of blockchain technology.

“I was initially a crypto skeptic, but…I have come to believe that crypto can enable the formation of useful businesses and technologies that heretofore could not be created.”

Crypto can enable the formation of useful businesses and technologies that heretofore could not be created.

Ability to issue a token to incentivize participants in a venture is a powerful lever in accessing a global workforce to advance a project.

“Despite crypto’s ability to facilitate fraud, with the benefit of sensible regulation and oversight, crypto technology’s potential for beneficent societal impact may eventually compare with the impact of the telephone and internet on the economy and society.”

“I began to understand how a token could build intrinsic value over time.”

“I think crypto is here to stay and with proper oversight and regulation, it has the potential to greatly benefit society and grow the global economy.”

Blockchain technology allows token holders to have confidence in their tokens' basic parameters including their total current and eventual supply, and recognition of the holder’s ownership.

In the dot com bubble, investors gave Pets.com and Webvan massive valuations before they eventually went bankrupt as enthusiasm about internet-based business models drove enormous speculation and fraud. The same is happening now with crypto.

“I wouldn’t be so fast to conclude that crypto is a worthless technology simply because of some bad actors and some underperforming businesses.”