Meta Investments News: FTX Explained

This is a special edition focused on the high profile situation with FTX.

1. Intro to FTX and Sam Bankman-Fried.

2. What is a Cryptocurrency Exchange?

3. Prominent FTX Investors and Customers.

4. Overview of Events Leading to FTX Bankruptcy.

5. Is Crypto Dead… Again?

1. Intro to FTX and Sam Bankman-Fried

FTX is was a high profile cryptocurrency exchange with operations around the world.

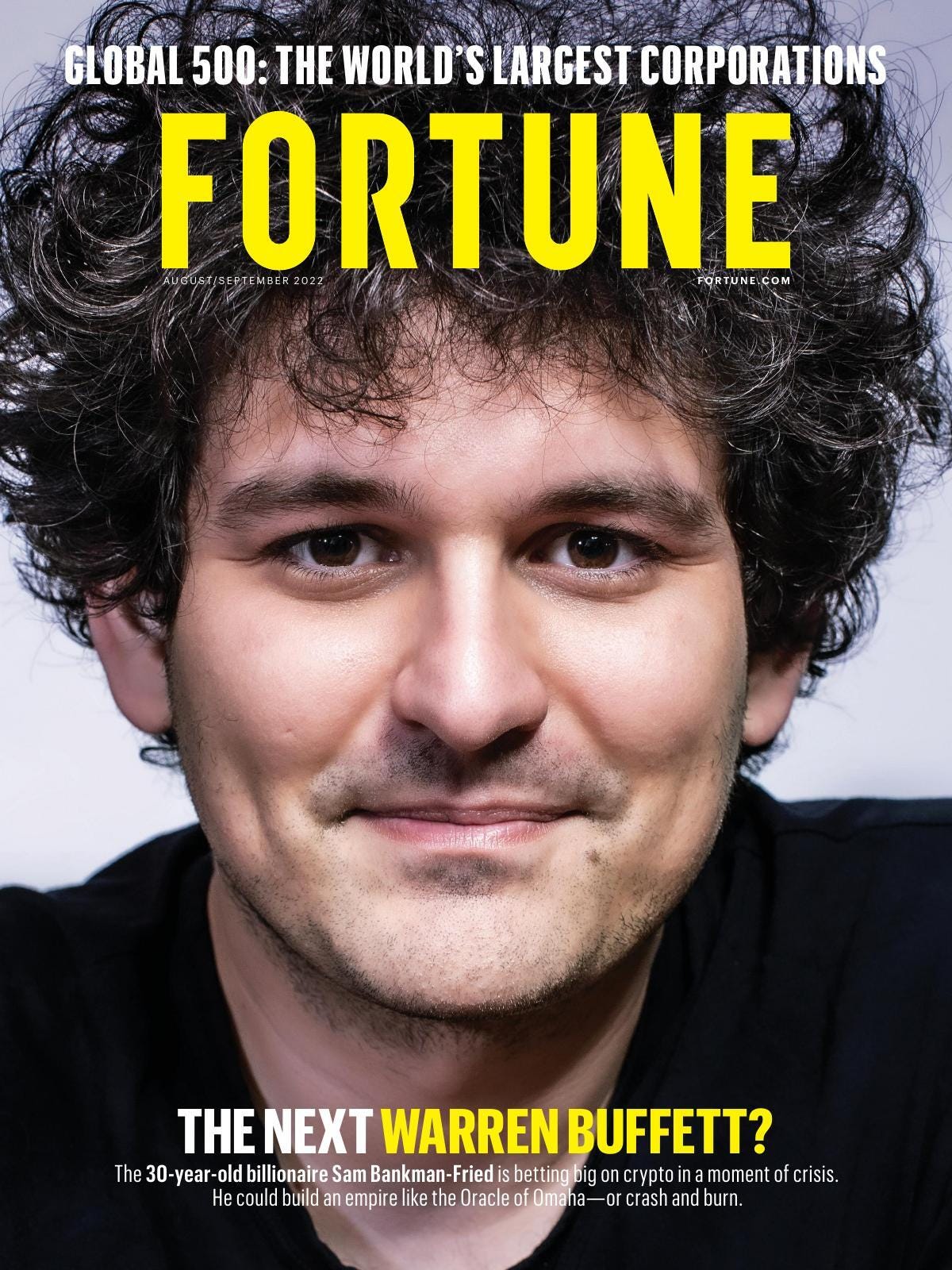

FTX was led by Sam Bankman-Fried or “SBF”. At 30 years old, SBF was one of the world’s youngest billionaires amassing a crypto fortune of $20B+ earlier this year.

SBF graduated from MIT in 2014 with a degree in physics and a minor in mathematics.

He spent ~4yrs trading at Jane Street Capital, which is a well known market maker (or liquidity provider) for stocks.

Liquidity providers profit between the difference of a price quoted by the seller (ask) and price requested by buyer (bid).

Known as the “bid-ask spread”.

SBF launched FTX in 2019 and the company enjoyed a high profile:

Venue naming rights for Miami Heat: $135 million for “FTX Arena” until 2040.

Cryptocurrency Exchange of MLB: umpires wear a patch with FTX's logo.

Celebrity endorsers, including Tom Brady: “Are you in?”

Larry David was also enlisted: “Don’t Miss Out on Crypto”.

(admittedly, this commercial is hilarious)

UNIDENTIFIED ACTOR: “Like I was saying, it's FTX. It's a safe and easy way to get into crypto.”

LARRY DAVID: “I don't think so. And I'm never wrong about this stuff - never.”

2. What is a Cryptocurrency Exchange?

Cryptocurrency exchanges offer an “on-ramp” into purchasing cryptocurrency tokens and “off-ramp” back into fiat.

Cryptocurrency exchanges generally earn fees through transactions:

Market maker: take the bid–ask spreads as a transaction commission; and/or

Matching platform: simply charge fees or commissions.

FTX earned income / generated capital through additional products and services:

Offering line of credit facility (i.e. debt).

Ability to buy and exchange non-fungible tokens (“NFTs”).

Debit cards issued through Visa. Users can spend their balance offline with the platform charging interchange fee for transactions.

Variety of tradable instruments (futures, perpetual futures, options, tokenized assets like stocks, and even bet on real-life events).

Balance sheet investments in other crypto & blockchain startups.

Understandably, customers that deposit fiat or hold crypto on exchanges expect their deposits to be available.

FTX’s additional products/services and its high profile led it to become more popular than a typical exchange, which led to…

Large/growing pool of customer deposits.

Strong investor interest.

SBF the “Wunderkind”: young and wielding influencial billionaire.

3. Prominent FTX Investors and Customers.

FTX was an “overnight success” and quickly rose to astronomical heights:

August 2019 Seed Round: raised $8m in funding.

December 2019 Series A: Binance invested an “undisclosed” amount as part of a strategic partnership between the firms.

*Important: Binance received FTX native coin $FTT in return for their investment*July 2021 Series B: raised $900 million at $18 billion valuation.

January 2022 Series C: raised $400 million at $32 billion valuation.

FTX was recently in talks with investors to raise an additional $1 billion.

Investors included some of the most prominent names in the world: BlackRock Inc., Sequoia, Softbank Group Corp., Ontario Teachers' Pension Plan, Tiger Global Management, Temasek Holdings, and Thoma Bravo.

UNIDENTIFIED ACTOR: “Like I was saying, it's FTX. It's a safe and easy way to get into crypto.”

LARRY DAVID: “I don't think so. And I'm never wrong about this stuff - never.”

On Friday November 11 2022, FTX (and ~130 affiliated FTX companies) filed Chapter 11 bankruptcy.

Paradigm told investors that it marked down its $290 million investment to zero.

Sequoia Capital wrote down the full value of its $214 million investment.

Softbank is expected to write off its $100 million investment.

Ontario Teachers’ issued a statement disclosing its $95 million investment.

Beyond losses disclosed by direct investors, customer deposits are frozen.

The hope is that a (small) fraction of deposits will be recoverable sometime in the future.

FYI. Mt. Gox exchange went under in 2014 and affected customers have not received anything (8yrs. later!).

FTX customers include (1) retail investors; (2) startups with fiat/tokens on the exchange; and (3) funds that traded on the exchange.

For example, Multicoin Capital - a prominent cryptocurrency venture fund - had 10% of its fund's AUM (or ~$900 million) stuck on the FTX exchange.

Implications: impact of FTX bankruptcy will cascade throughout the crypto ecosystem.

—

*Note: The FTX Token (“FTT”) - received by Binance for their 2019 investment - was created to provide traders with a way to save on trading fees. When users paid for their trades using $FTT, they were given a discount on the fees charged. The more $FTT held by a user, the bigger the discount received.

In terms of value accrual, one-third of FTX's trading revenue was used to purchase and burn $FTT supply, so as trading revenue increased, it supposedly created intrinsic value and increased the market cap of the $FTT token.

Some would say that the downfall of FTX was inevitable - based on the history & relationship with Binance alone:

Binance received FTX’s native coin $FTT in return for their 2019 investment.

FTX and Binance subsequently became competing exchanges.

The relationship between Sam Bankman-Fried and Binance Founder/CEO (“CZ”) soured…

4. Overview of Events Leading to FTX Bankruptcy.

Sam Bankman-Fried controlled two “distinct and separate” entities:

FTX: Cryptocurrency exchange.

Alameda Research: quantitative trading firm specializing in cryptocurrencies. Its strategies include arbitrage, market making, yield farming, and trading volatility.

Alameda was founded before FTX and quickly grew in notoriety and profits.

FTX, Almaeda and SBF were riding high until CoinDesk’s November 2, 2022 article set the death spiral in motion: “Divisions in Sam Bankman-Fried’s Crypto Empire Blur on His Trading Titan Alameda’s Balance Sheet”.

As of June 30, Alameda’s assets amounted to $14.6 billion. Most of this asset was the FTX token: “FTT”.

Alameda’s single biggest asset was $3.7 billion of “unlocked $FTT.” Unlocked = traded at any time.

The third-largest assets was $2.2 billion of “FTT collateral.” This is $FTT held as margin or support for debt taken by Alameda.

On November 6, 2022 Binance’s CEO tweeted they were exiting their FTX position, which consisted of a material amount of $FTT tokens:

The reason for exiting the position were subsequently announced by CZ:

Risk Management;

The friendship soured: “we won't pretend to make love after divorce”; and

FTX was lobbying for crypto regulation against other industry players rather than “with” (i.e. unscrupulous behaviour).

Those tweets were the deathblow to FTX (and Almaeda):

November 6 & 7: people panicked and sold $FTT, which sent $FTT spiralling down.

$FTT fell from ~$22 to <$5, wiping out more than $2 billion in a day.

Alameda's balance sheet / collateral evaporated.

November 6-8: People panicked and ran to withdraw funds from FTX.

$6 billion of deposits removed from the exchange within 3 days.

November 8: FTX faced a liquidity crisis and paused withdrawals.

November 8: Binance issues non-binding LOI to acquire FTX (attempt to create calm in the market).

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days.November 9: news surfaces that FTX illegally extended $ billions of customer deposits to “distinct and separate entity” Alameda for trading purposes.

November 9: Binance calls off potential acquisition of FTX.

November 11: Sam Bankman-Fried steps down as FTX CEO as his crypto exchange files for bankruptcy.

November 15: SBF takes to Twitter to defend himself with the intention to, “Raise liquidity, make customers whole, and restart.”

5. Is Crypto Dead… Again?

Neither blockchain technology nor cryptocurrency failed in this circumstance.

SBF was a bad actor managing a centralized (unregulated) company that mismanaged customer funds.

Fred Wilson sums it up well via “Taking A Long Term View Of Web3”

Most of the well-known meltdowns in web3, going all the way back to Mt Gox and including recent failures like 3AC, Celsius, and Alameda/FTX, have happened to centralized companies operating trading, lending, and speculating businesses.

Many of the failures have been offshore and all of them were largely unregulated.

Contrast that with regulated web3 businesses like Coinbase, Kraken, and Anchorage that operate in the US and you will see that the companies that have followed the rules and behaved properly have weathered these storms.

The most important software innovation of the last decade, which started with the Bitcoin white paper fourteen years ago, is the emergence of open-source software and decentralized protocols that are the foundation of web3.

It is the promise of software that is not controlled by a company, but instead by an open-source community with built-in safeguards and increased transparency relative to today’s tech and financial systems, that gives us so much confidence in the future of web3.

Eventually, as the web3 infrastructure improves, the user experience gap between self-custody and storing assets on centralized entities will shrink. More users will feel comfortable self custodying their assets in software they control and managing the keys that provide access to their assets themselves.

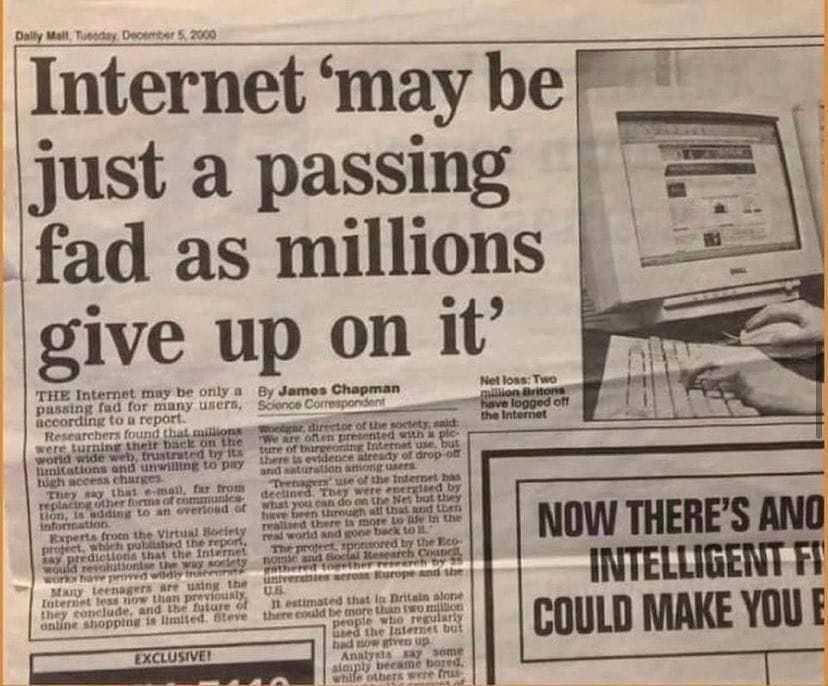

Do you remember the dot-com implosion?

The notorious dot-com bubble was a period from 1995 to 2001 where internet-related tech companies attracted a massive amount of attention from venture capitalists and traditional investors alike.

Investors poured billions in US equity funds:

$150 billion in 1998;

$176 billion in 1999; and

$260 billion in 2000.

Everyday people were the most aggressive investors in the dot-com bubble at the very moment the bubble was at its height…

By 2002, 100 million individual investors had lost $5 trillion in the stock market (!).

Newspapers reported that the underlying technology would not survive.

We all know that the technology was real. Moreover, the most valuable companies in history emerged.

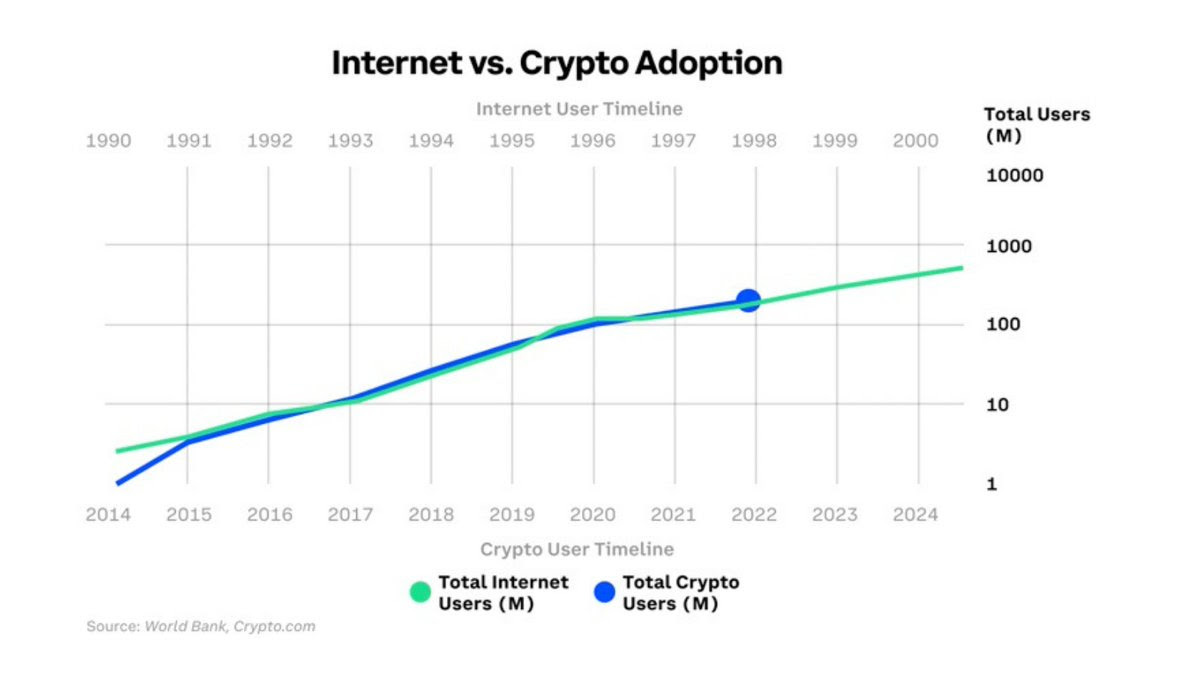

So, what about blockchain?

Ark Investments' Big Ideas 2022 report (accessed here) provides concrete examples of disruptive blockchain applications.

It goes on to estimate that the market cap of cryptocurrencies can grow from $1.4 trillion at the end of 2020 to $49 trillion by 2030 = or 35x growth(!)

Blockchain introduces a trustless, peer-to-peer, decentralized technology that operates without human intervention: 24 hours a day. 7 days a week. 365 days a year.

It is open-sourced, publicly verifiable and available to anyone with a simple internet connection anywhere in the world.

Blockchain technology is transformational.

It offers the opportunity to reshape virtually everything we know - like the internet did to society. Its adoption also mirrors that of the internet.

We remain optimistic about the impact that blockchain technology will have on virtually all aspects of our lives.

This too shall pass…