Meta Investments News (June 2022)

Meta Investments News is a monthly newsletter sent to our investors and supporters.

Top News/Articles for June 2022

Inflation: What is it? Where is it? What does it mean to me?

(Discussed Below)Crypto Market Contagion

(Discussed Below)Long-awaited bipartisan digital asset bill from U.S. Senators Cynthia Lummis (R-Wyo.) and Kirsten Gillibrand (D-N.Y.) to create comprehensive set of regulations across digital assets in the U.S.

Proposed federal law for stablecoins, taxes on small-scale payments and the jurisdictions of regulators to address uncertainties preventing widespread adoption.

Define - and distinguish between - crypto securities and commodities.

Propose Commodity Futures Trading Commission (“CFTC”) authority over spot markets in crypto commodities.

Industry “sandbox” for regulators to let crypto firms test new products on a limited scale and duration.

McKinsey in Conversation with Marc Andreessen from a16z

Marc Andreessen has been at the forefront of creating, and investing in, internet companies, mobile companies, artificial intelligence companies,… and more.

Incredible wave of talent in the form of top-end engineers, scientists, executives, and founders flooding into AI, Biotech and Crypto/Blockchain/Web3.

Web3/blockchain/crypto is foundational.

As foundational an architecture shift as the ones from mainframes to PCs, from PCs to web, from web to mobile, or from traditional software to AI.

What We’re Listening To

John Collison in conversation with Stanley Druckenmiller: 2022 Investment Conference

What Bitcoin Did w/ Dan McArdle: A Lesson in Bitcoin Volatility

Empire w/ Josh Rosenthal: The Crypto Renaissance Has Begun

Pomp Podcast w/ Nic Carter: The Systemic Issues In American Financial System

Harvard Business School Interview with Seth Klarman: Opportunities and Pitfalls for investors in 2022

Inflation: What is it? Where is it? What does it mean to me?

We cannot hide from the word inflation these days.

It is splashed across newspapers and magazines.

It is the topic of conversation on tv and among friends/family.

We see inflation in the price of everything as our dollar does not go nearly as far as it used to (quite literally with a tank of gas…).

What is it: Inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year.

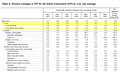

Where is it: Inflation has popped up across virtually every good and service, with a particular spike in Food and Energy.

source: US Department of Labour

What does it mean to me: We spend more money to receive less, which means our income is deteriorating (rapidly).

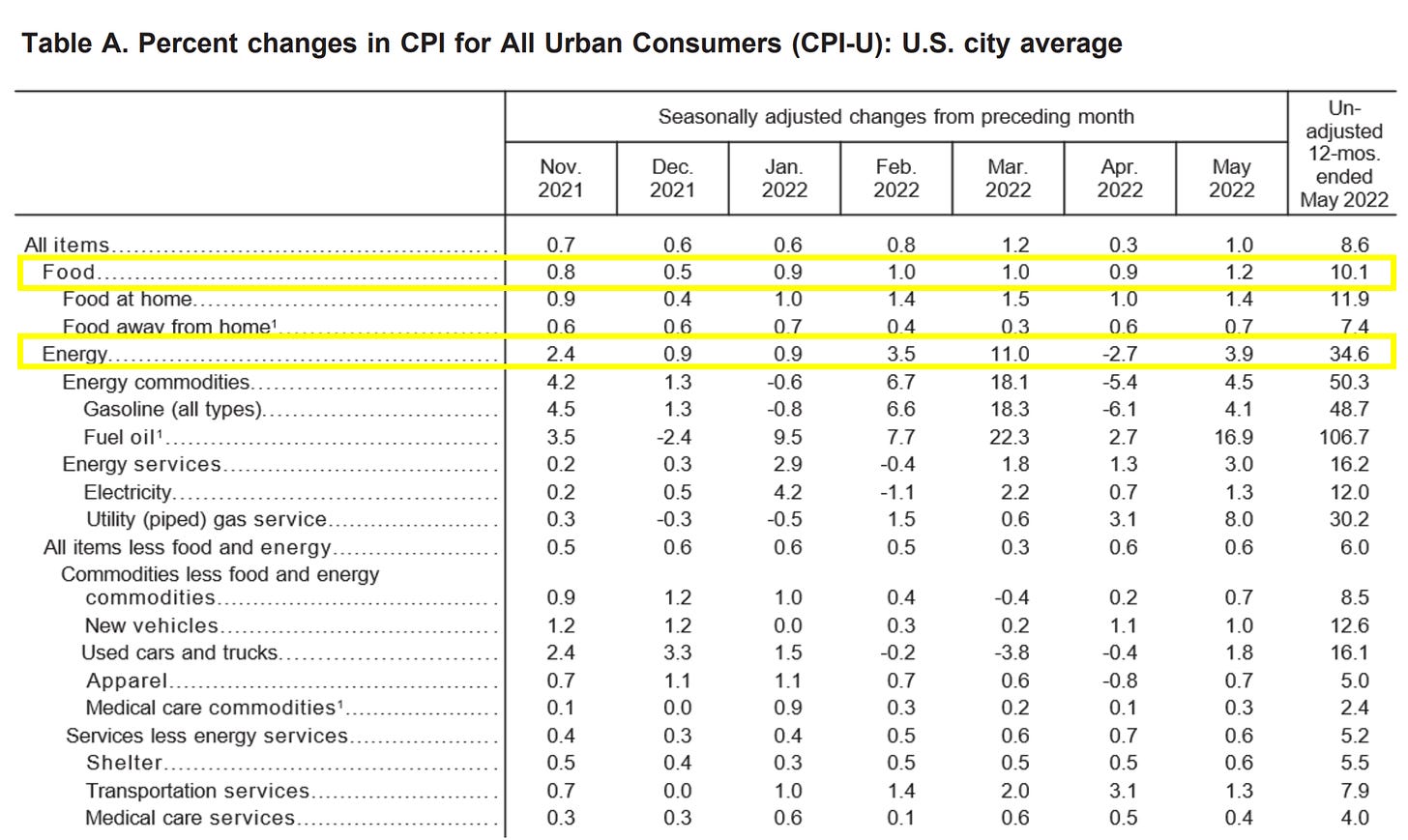

The war between Russia and Ukraine plays a key role in the price increase of Food and Energy.

(1) Ukraine supplies a meaningful percentage of key crops and food globally.

Before the war, 90% of Ukraine's exports left via deep ports in the Black Sea. These ports are now closed.

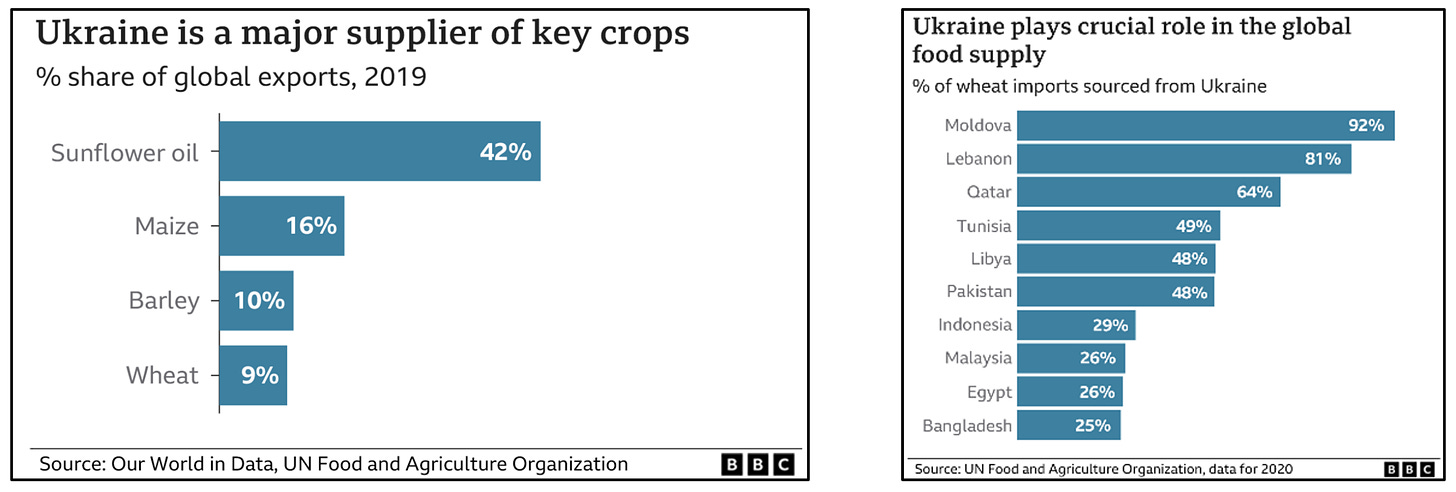

(2) Russia supplies a meaningful percentage of energy to Europe. Moreover, many countries are dependent on Russia for their energy.

The European Union banned the bulk of Russian energy imports.

Communities around the world are scrambling to meet their energy requirements.

Reduced supply of energy met with the same (or increasing) demand = material price increases.

Moreover, oil is used in virtually everything:

Fuel.

Plastics.

Clothing.

Toiletries.

Gum.

Oil (and energy) is also used to transport virtually everything.

As the price to consume energy increases, so does the price of virtually every good. Period.

The US Federal Reserve can’t increase the supply of energy or other goods/services.

Instead, we are experiencing a period of Quantitative Tightening (“QT”) that includes raising interest rates to reduce demand for goods and services.

All else being equal, prices fall as demand decreases.

[QT also has an adverse impact on growth stocks and the “future of… everything”, which was discussed in last month’s newsletter.]

“History doesn’t repeat itself, but it often rhymes”

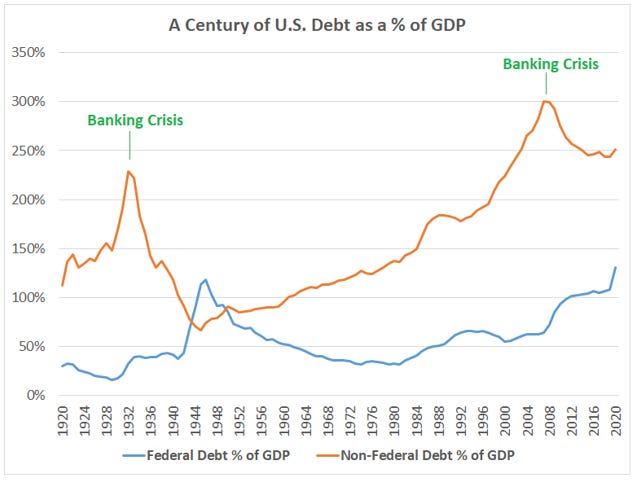

In Lyn Alden’s June newsletter, she discusses how the 2000s, 2010s, and 2020s is a quantitative rhyme of what happened in the 1920s, 1930s, and 1940s for the United States.

The 1940s and the 2020s (thus far) were both periods of major fiscal dominance, or “wartime finance” after a long period of rising populism, economic stagnation, and an external catalyst.

Faced with a war in the 1940s and a pandemic/lockdown in the 2020s, the federal government performed absolutely massive fiscal spending, and drove federal debt/GDP to around 130% in both instances.

Broad money supply expanded rapidly, and price inflation followed with a lag. However, because debt levels were already so high, the Federal Reserve was slow in both cases to raise interest rates, resulting in significant currency and debt devaluation.

But the 1940s and 2020s are different in other (important) ways:

(1) Back in the 1940s, the US was a rising power in terms of its share of global GDP and ran a structural trade surplus.

Today the US is a waning power in terms of its share of global GDP, and runs a structural trade deficit.

In many ways, the closest comparison to what the United States is going through in the 2020s, is what the United Kingdom went through in the 1940s.

Back in the 1930s and 1940s, the United Kingdom had the global reserve currency, but was running a structural trade deficit, was losing ground in terms of its global share of GDP, spent a lot of its resources on World War I, and began doing even more massive fiscal spending to fight World War II.

(2) Productivity of fiscal spending in the 1940s focused on building industrial manufacturing facilities, sourcing commodities, hiring soldiers, and sending those returning soldiers to technical school or universities to get them educated and ready for the domestic workforce.

In contrast, most of the stimulus during 2020 and 2021 went to keeping consumers and businesses solvent despite the reduction in productivity that came with the pandemic and lockdowns.

(3) The US (and developed world in general) had much younger demographics in the 1940s.

After the decade of war ended, their governments could turn towards austerity to rein in the money supply growth and return to a period of more normal monetary and fiscal policy, especially since they were enjoying a productivity boom.

The demographics pyramid today is very top heavy, which means that government deficits to support senior citizens’ retirement and healthcare systems are quite big.

There is no ability for developed countries to practice fiscal austerity, unless they’re willing to blow up all of these systems and nominally default on some of their government debt.

There is currently massive debt-to-GDP in the system, both in the private sector and at the federal level.

Raising interest rates above the official inflation rate (e.g. over 9%) would result in widespread insolvency.

Faced with inflation, central banks including the US Federal Reserve have been rather slow to tighten monetary policy to stave off widespread insolvency.

Will this round of increasing interest rates to reduce spending and decrease the supply of money work?

We’re in the process of finding out.

In the meantime, financial markets are in calamity with liquid investments such as public equities + high risk investments (e.g. crypto) experiencing material price corrections.

Is now the time to be, “Greedy When Others Are Fearful” as Warren Buffett once famously said?

Crypto Market Contagion

The crypto industry experienced a tidal wave of defaults during the month of June.

Contagion ripped through the market like falling dominos destroying established and prominent institutions.

The top reasons for defaults include (1) over-leverage (i.e. investing with debt) and (2) mismatching the timing + duration of assets / liabilities.

Example 1: investing with margin backed by the pledge of assets as collateral. If the underlying investment decreases then additional collateral is required to support the position. Alternatively, the underlying collateral is sold to cover the loss. If that underlying collateral happens to decrease in value (e.g. BTC) then the loss spirals down further.

Example 2: accepting customer deposits and offering high yield returns and locking customer funds into long-term contracts. This leads to deposits being inaccessible in the short term and unavailable for withdrawal on demand.

These unfortunate situations occur in traditional markets. However, volatility within the cryptocurrency market magnifies these problems further.

Below are a few headlines from June 2022:

Three Arrows Capital (“3AC”): Sophisticated hedge fund launched in 2012 and known as THE smartest traders.

Managed ~$18bn of assets at its peak.

Now considered bankrupt after (1) losing significant capital from the Terra/Luna collapse (discussed last month); (2) forced liquidations used for collateral (margin calls); and (3) inadequate capital to repay lenders (more info).

BlockFi: Crypto lender and service provider founded in 2017: 1+ million clients and $10 billion assets with a recent valuation of $5 billion.

Company provided a material loan to 3AC capital (rumoured to be $1B) backed (or collateralized) by bitcoin. 3AC was unable to repay the loan and the underlying price of bitcoin fell leaving a substantial debt outstanding.

Cryptocurrency exchange FTX recently provided a $400M revolving credit facility to BlockFi.

FTX also has an option to acquire the company (along with its liabilities) for an amount that may turn out to be $25 million or 99% BELOW BlockFi’s latest recent valuation (CNBC has more info).

Celsius: Crypto-lending and interest bearing platform founded in 2017: $8.2B in loans processed, $11.8B in assets and raised $750M in the fall of 2021 at a valuation of $3.5B.

Company used customer deposits for long-term and illiquid investments.

Also used deposits to increase customer yield in riskier projects, which ultimately went under.

Celsius halted all withdrawals, swaps, and transfers (Celsius blog post).

Voyager Digital (VOYG.TO): Crypto brokerage valued at $5 billion at its peak.

Company issued default notice to 3AC after 3AC failed to make required payments on loans of 15,250 bitcoins (~$305M at $20k/BTC) and $350 million in USDC.

FTX recently provided a $500M revolving credit facility to Voyager.

July 1: Voyager suspended trading, deposits, withdrawals and loyalty rewards (Voyager news release).

There are analogs to the aforementioned collapses found in traditional finance:

3AC <> Long-Term Capital Management (“LTCM”)

Famed Salomon Brothers bond trader (John Meriwether) founded LTCM in 1994.

Included an all-star team of traders + academics known on the Street as THE smartest.

Fund lost substantial amounts of investors' capital and was on the brink of default four years later in 1998.

US Federal Reserve orchestrated a $3.5 billion rescue package from leading U.S. investment and commercial banks to avoid the threat of a systemic crisis in the world financial system (more details here).

There was no Federal bailout orchestrated for 3AC.

Celsius <> Lehman Brothers

Celsius calls for people to “Unbank” themselves on its website and bragged about customer deposits that can earn 17%.

Celsius’s liquidity crisis traced back to a shift in lending strategy with riskier bets to generate higher yield.

Lehman Brothers shifted their strategy back in mid-2000s when mortgage-backed securities became increasingly popular for offering increasing return via “diversification” of risk.

Mortgage backed security market ultimately collapsed in 2007/2008 and brought Lehman down with it.

Barclays bought Lehman Brothers' U.S. operations after it filed for bankruptcy and Normura purchased the firm's Asian and European operations.

A number of firms are vying for the assets of Celsius with Goldman Sachs positioning itself as the deal broker (more details here).

There are many lessons from traditional markets that can be applied to the nascent crypto markets.

Leverage is powerful but potentially deadly. Understand the risks (vs. focusing exclusively on the rewards).

Match duration of assets and liabilities. Short term customer deposits cannot be used to invest in long term projects/contracts.

Cash needed in the short-to-medium term should not be used to invest (or speculate) in volatile investments.

If it seems to good to be true then it is! This includes unsustainably high yields.

Cash = optionality. It is tempting to go “all in” when the market is hot but liquidity affords opportunities. Cash creates breathing room and/or room for future opportunities.

Do your own research (“DYOR”) and invest in what you know. Do not borrow someone else’s conviction to make your own investment decisions. That person may be in a different circumstance, may overlook important facts, and may have a different risk threshold,… if you’re not laser focused and your time is not fully committed then rely on a professional or dedicated investment advisor.

Crypto Lesson: “Not your keys, not your crypto”.Blockchain technology provides the opportunity to remove reliance on centralized institutions. For the first time in history, you can custody your own assets and conduct commerce permissionlessly with anyone/anywhere/anytime 24hrs a day. 7 days a week. 365 days a years. via a hardware wallet like Ledger.

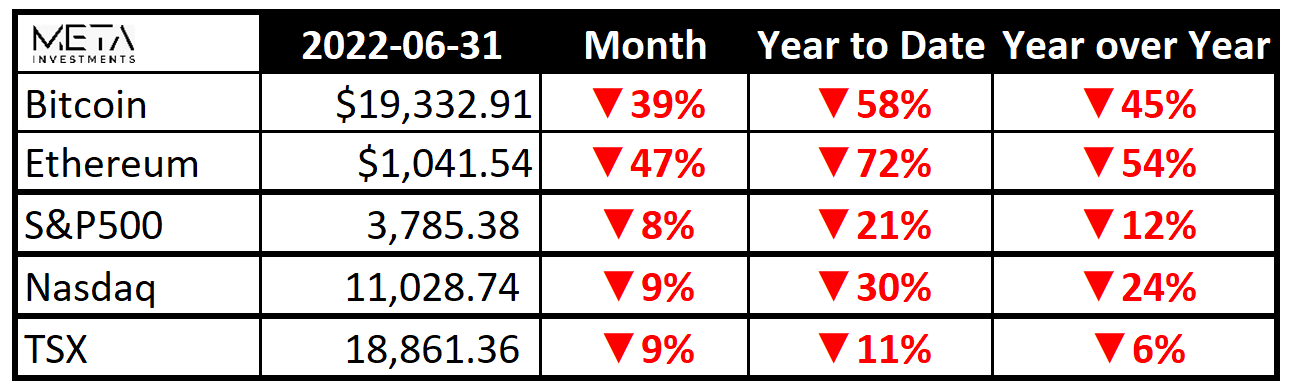

June Cryptocurrency Market Update.

The financial markets experienced a significant correction in June.

“Risk Off” and “Flight to Safety” continue to be the main investment theme of 2022, which generally means that liquid investments typically correlate to 1 in this type of situation.

Virtually nothing in spared as skittish (and emotional) investors sell liquid holdings for the “safety” of cash.

The flight to cash is understandable given market uncertainty (see last month’s “stock prices feel like they will never reach a bottom…”).

Time in the market vs. timing the market.

The challenge of market timing is that one needs to determine when to re-enter. Bank of America has quantified how large the missed opportunity can be for investors who try to get in and out at “just the right moment”.

Looking at data going back to 1930, [Bank of America] found that if an investor missed the S&P 500′s 10 best days each decade, the total return would stand at 28%.

If, on the other hand, the investor held steady through the ups and downs, the return would have been 17,715%.

Given the difficulty of precisely calling the peaks and troughs, the better strategy is to stay in invested.

Time in the market vs. timing the market.

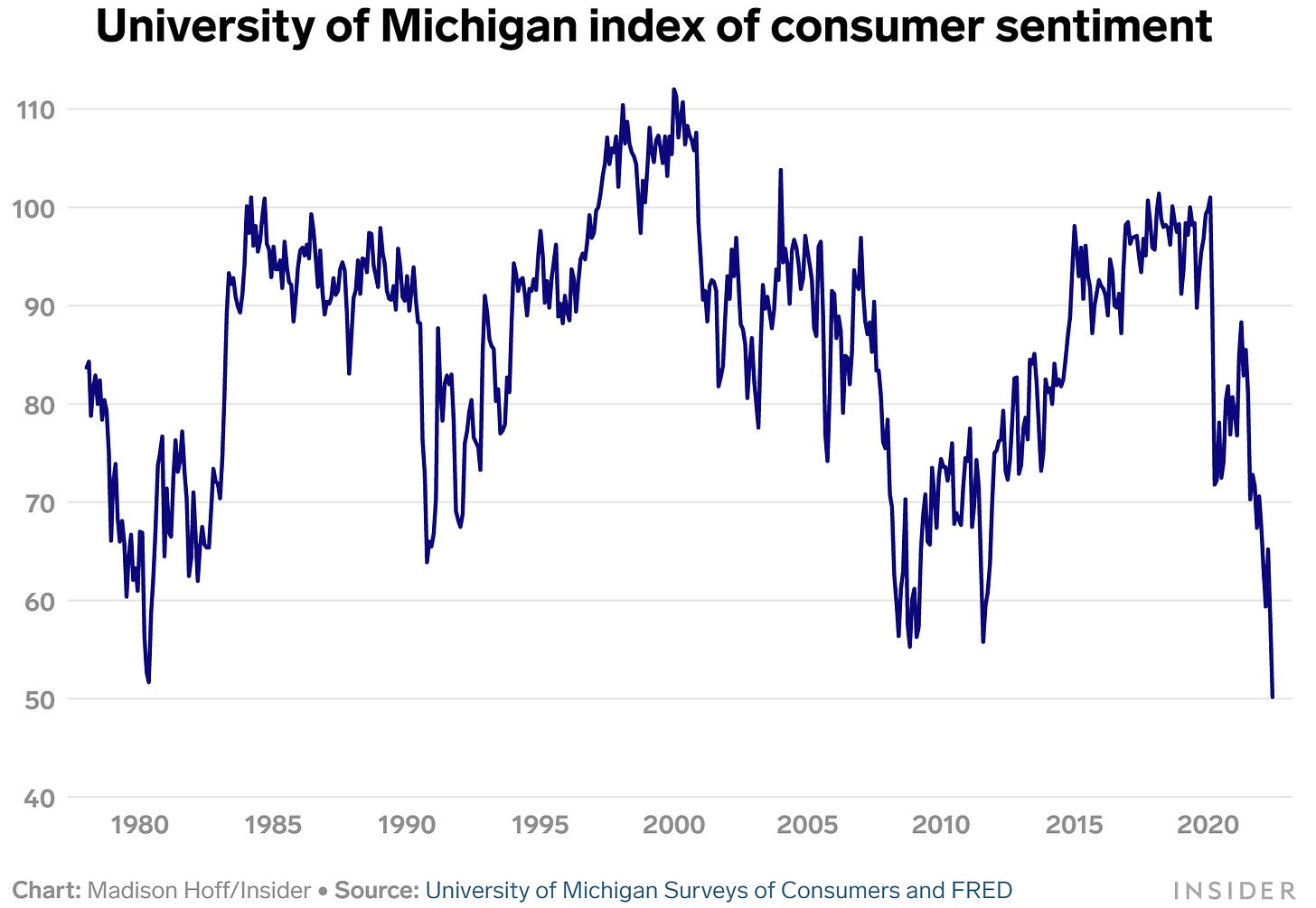

The turbulent financial markets were impacted by a number of factors in June, including inflation (discussed above), aggressive interest rate hike (largest in ~20yrs) and consumer sentiment (lowest in 50yrs!):

Fed hikes benchmark interest rate by 0.75 percentage point, the biggest increase since 1994

"First-quarter growth declined at a 1.5% annualized pace and an updated estimate… put the second quarter as flat."

"Officials also significantly cut their outlook for 2022 economic growth."Americans have never felt this bad about the economy

"The University of Michigan's consumer sentiment index cratered in an early June reading… the lowest level since regular monthly data collection began in the late 1970s."

Meta Investments maintains that Bitcoin and Ethereum will play a prominent role in our increasingly digitally native future.

We remain very bullish on the investment opportunity that blockchain + cryptocurrencies represent, especially at these price levels.