Meta Investments News (May 2022)

Meta Investments News is a monthly newsletter sent to our investors and supporters.

Top News/Articles for May 2022

Meta Musings from the Pandemic

(Discussed Below)Crypto's Biggest Collapse: $60 Billion Wiped Out

(Discussed Below)Introducing the 2022 State of Crypto Report by a16z

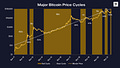

We’re in the middle of the fourth ‘price-innovation’ cycle: Markets are seasonal; crypto is no exception.

Web3 [powered by blockchain] is much better for creators than web2: take-rates of web2 giants are extortionate; web3 platforms offer fairer economic terms.

Crypto is having a real-world impact, including un-banked, under-banked and other broken marketplaces.

Ethereum is the clear leader, but faces competition.

Yes, it’s still early: we are somewhere around 1995 in terms of development using internet adoption as a metaphor.

What We’re Listening To

Richer, Wiser, Happier w/ Bill Miller: Amazon, Bitcoin & Buffett

Bankless w/ Marc Andreessen & Chris Dixon of a16z: Reinventing the Internet

Empire w/ Olaf Carlson-Wee: How To Survive A Bear Market

Unchained w/ Cobie and Chris Burniske: How to Navigate a Crypto Bear Market

Meta Musings from the Pandemic.

Volatility: when a market or security experiences periods of unpredictable, and sometimes sharp, price movements.

Volatility in financial markets is exhilarating on the way up.

Excitement is contagious. Emotions take hold. Casual investors transform into expert stock pickers + informed advisors overnight.

Widespread enthusiasm sends the price of equities screaming above reasonable (“intrinsic”) value.

Stock prices feel like they will soar in perpetuity… until they don’t.

Volatility is terrifying on the way down.

Confidence is shaken. Panic takes hold. Casual investors lose faith. Equities lose control.

Stock prices feel like they will never reach a bottom… until they do.

Countries around the world avoided complete economic destruction due to quick and extreme Quantitative Easing by Central Banks in response to the COVID pandemic.

Quantitative Easing (“QT”): Central Banks purchase securities in an attempt to reduce interest rates, increase money supply and drive more lending to consumers & businesses.

Result: Valuations soar and equities increase.

Quantitative Tightening (“QT”): Central Banks increase interest rates to motivate saving and decrease liquidity within economy.

Result: Valuations plummet and equities decrease.

At the onset of COVID, free money was sent to virtually every household + business throughout North America and borrowing rates were lowered to historic levels to stimulate economic demand.

Stimulate economic demand? BUT, we had nowhere to go and nothing to do.

We were confined to our homes and restricted from traveling, eating out, attending events,...

Enter the casual investor who morphed into an expert stock picker overnight:

Zoom = virtual meetings at virtually any valuation.

Peloton = can you put a price on health or the value of this fitness stock?

Netflix = THE standard for great content like Tiger King, Bridgerton, Squid Game,… priceless.

[insert TOP pandemic stock here]

Governments, schools, employers and individuals embraced technology to conduct business, facilitate learning, and continue socializing.

McKinsey & Company wrote a great piece about this period of accelerating technology: “Digital adoption has taken a quantum leap”.

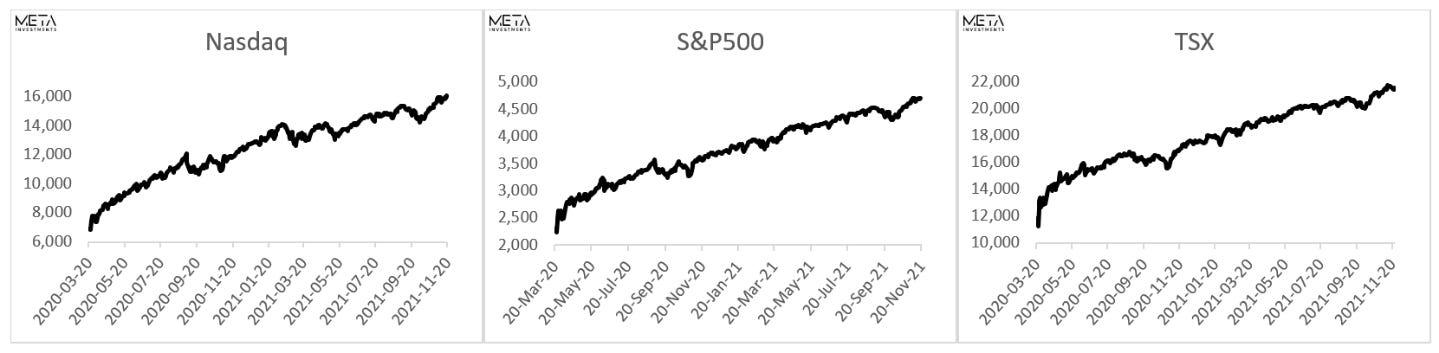

Equities touched their lows in March 2020 then raced upwards through the fall 2021:

Nasdaq = +134%

S&P500 = +110%

TSX = +92%

Growth stocks and the “future of… everything” took off. You. could. not. lose.

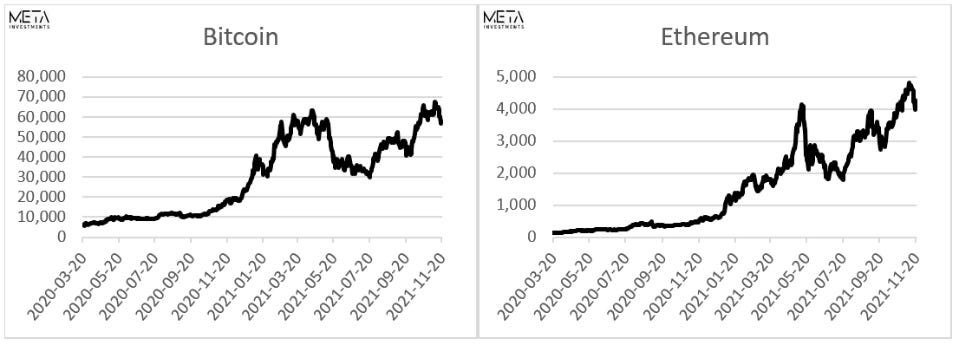

Cryptocurrencies - often considered among the most disruptive technologies - soared during this period:

Bitcoin: +1,058%

Ethereum: +3,829%

Bitcoin: consensus network that enables a new payment system and a completely digital money. The first decentralized, censorship-resistant, peer-to-peer payment network powered by its users with no central authority or middlemen. (see Fidelity’s excellent Bitcoin write-up).

Ethereum: open-source, blockchain-based, general purpose decentralized application platform, enabling smart contracts. It employs the Ethereum Virtual Machine (“EVM”) to implement & execute peer-to-peer + multiparty agreements among other applications. (see Fidelity’s excellent Ethereum write-up).

Stock prices felt like they would soar in perpetuity… until Central Banks communicated Quantitative Tightening in the fall of 2021.

Suddenly, the music stopped. As Buffett famously said, “Only when the tide goes out do you discover who's been swimming naked.”

Growth stocks and the “future of… everything” were metaphorically swimming naked and came crashing down to earth (and lower).

You. could. not. win:

Nasdaq: -24% since November 2021.

S&P500: -11% since January 2022.

TSX: -4% since March 2022.

Bitcoin: -53% since November 2021.

Ethereum: -59% since November 2021.

The casual investor started singing a different tune and re-entered hibernation:

Zoom = “You know, Zoom fatigue is a real thing.”

Peloton = “It’s really a glorified laundry hamper.”

Netflix = “I finished Netflix. On to another provider…”

Ignoring market extremes, investments fared relatively well in the 2+ yrs since March 2020:

Nasdaq: +37%

S&P 500: +36%

TSX: +36%

Bitcoin: +444%

Ethereum: +1,528%

Interestingly, the media would lead us to believe that crypto is D.E.A.D.

Despite the broad market downturn and drop from COVID peaks, Bitcoin and Ethereum are well above equities. Volatile. But still higher.

Not all equities are equal.

Investors pay different prices depending on the company, stage and market condition.

Similarly, not all digital tokens are equal.

At Meta Investments, we ignore emotions, headlines, hype and over-opinionated / under-informed casual investors.

We consider factors such as (1) growth in users; (2) increasing applications; (3) security; (4) network effect; (5) tangible use cases / benefits; and more…

We digest available information to create informed investment decisions based on facts, evidence and critical details.

Crypto's Biggest Collapse: $60 Billion Lost.

We witnessed the biggest collapse in crypto's history in May.

We will do our best to explain the extreme carnage absorbed by retail & institutional investors below:

To understand the situation, it is important to have some context on stablecoins.

Stablecoins are essentially tokens on the blockchain tied (or “pegged”) to another currency. They are “stable” against a reference currency.

Stabelecoins remove the volatility associated with most blockchain-native cryptocurrencies + expand the use of financial applications on the blockchain.

Stablecoins allow anyone / anywhere to send money across the world in minutes for next to nothing, convert to another cryptocurrency, earn yield, lend, and more.

The most popular stablecoins are pegged to the US dollar.

There are 3 types of stablecoins: (1) Fiat-Collateralized Stablecoins; (2) Crypto-Collateralized Stablecoins; and (3) Algorithmic Stablecoins.

(see this post for our stablecoin primer)

Terra was a cryptocurrency network based on an Algorithmic Stablecoin called TerraUSD or $UST.

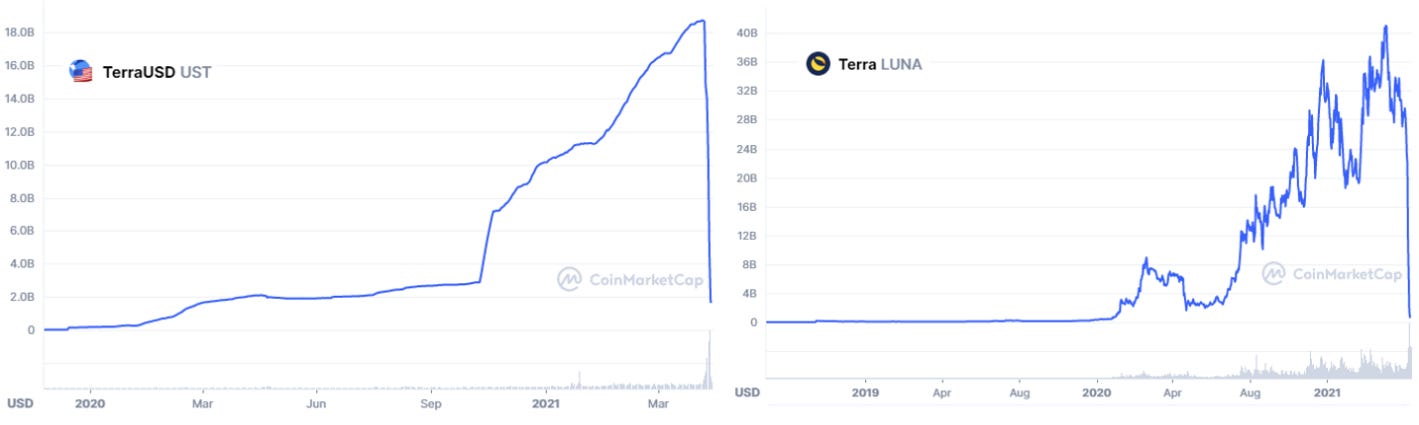

At its peak, $UST had ~$20 billion market cap. Its accompanying $LUNA token (used for $UST’s monetary control) had ~$40 billion market cap.

Based on a series of events, $UST de-pegged: 1 $UST ≠ $1 USD.

Token holders desperately sold whatever $UST they could once confidence was lost.

Once liquidity in $UST disappeared, the only way out was selling $LUNA.

The value of both tokens essentially vanished overnight.

Evidence suggests that this was a well-funded attack. A very large entity sold bitcoin short and went after the $UST peg.

The collapse in $UST is compared to the famous attack on the Bank of England by investors Stan Druckenmiller and George Soros in 1992:

August 1992: Druckenmiller held $1.5 billion bet against the pound.

September 1992: devaluation of sterling appeared inevitable and Soros advised Druckenmiller to “Go for the jugular.”

Druckenmiller and Soros ultimately shorted >$10 billion worth of $GBP and earned a profit of $1 billion, decimating the currency’s value in the process.

Britain itself lost £3.3 billion.

The collapse of $UST and $LUNA is poised to bring increased regulatory scrutiny to crypto.

We believe that appropriate and measured regulation will motivate participation by prospective crypto investors patiently waiting on the sidelines for clarity.

Our hearts go out to the people impacted by this situation.

It may take time to recover. However, crypto has proven its resilience time and again.

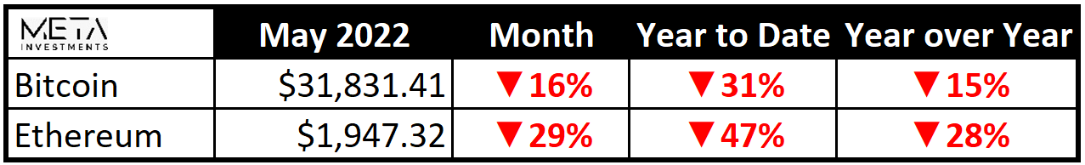

May Cryptocurrency Market Update.

Cryptocurrencies are generally viewed as a risky asset class. When equity markets correct, cryptocurrencies typically see deeper declines as investors aim to "protect" themselves through defensive cash positions.

Equities went on a wild ride during the month of May:

S&P 500: 9% from peak to trough. Ended flat.

Nasdaq: 13% from peak to trough. Ended -2%.

TSX: 7% from peak to trough. Ended flat.

On the other hand, Bitcoin and Ethereum were down heavily for a second straight month:

Bitcoin: -16%

Ethereum: -29%

Within a week of the Terra/Luna situation (discussed above), Bitcoin fell 27% while Ethereum was down 29%.

Bitcoin was sold short + Bitcoin and Ethereum were used as collateral for a number of investors.

Similar to pledging equities as collateral for margin trades:

If the acquired asset bought on margin (i.e. debt) starts to drop then lenders call capital.

Investors are required to post funds, which usually requires selling the underlying asset(s) pledged as collateral.

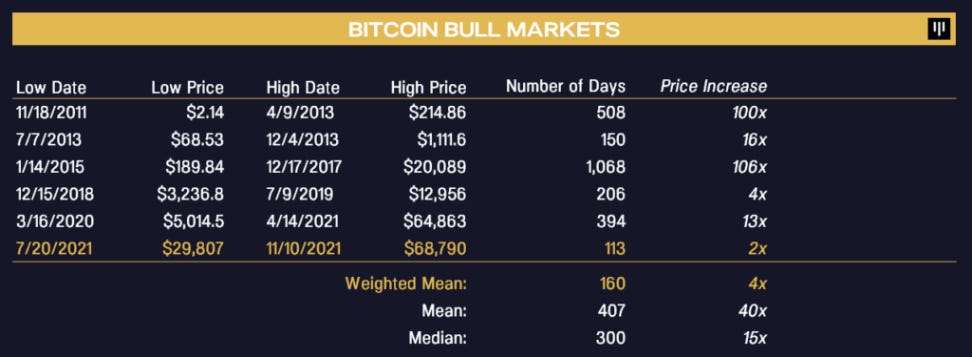

For further context, we are including Bitcoin’s volatility below:

88% corrections during “Bear Markets”

2x to 100x+ during “Bull Markets”

Zooming out further, we see that Bitcoin has done exceptionally well over time.

Meta Investments maintains that Bitcoin and Ethereum will play a prominent role in our increasingly digitally native future.

We remain very bullish on the investment opportunity that blockchain + cryptocurrencies represent, especially at these price levels.