Meta Investments News (August 2022)

Meta Investments News is a monthly newsletter sent to our investors and supporters.

This newsletter does not provide investment advice. Any views expressed are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Top News/Articles for August 2022

Market Update.

(Discussed Below)NFTs Continue To Go Mainstream.

(Discussed Below)Crypto fundraising through first half of 2022 surpasses all of 2021!

Crypto industry has raised $30.3B through the first half of 2022 compared with $30.2B for the entire year of 2021!!

$10B went to Centralized Finance (CeFi) = crypto exchanges, payment services, market makers, and savings/banking accounts businesses.

$9.7B went to infrastructure investments such as smart contract platforms, mining, data, and custody tools.

$8.6B went to Web3 and NFT with gaming-related NFTs capturing the lion’s share of investment.

Crypto and traditional funds raised an impressive $35.9B in the same period, surpassing the $19B raised for the whole year of 2021.

Crypto Funds: $25.9B

Traditional Funds: $10B

Note: According to PwC’s latest hedge fund report in June, 38% of hedge funds are now investing in digital assets, up from 21% in 2021.

90 Million Stores Worldwide Accepting Crypto Payments… soon.

Mastercard CEO Michael Miebach made the announcement via LinkedIn: ‘What could the blockchain industry look like in five years?’

Mastercard has teamed up with Binance - cryptocurrency infrastructure provider and exchange - to offer prepaid card bridging cryptocurrencies & fiat currencies

Currently in beta throughout Argentina with a plan to extend to the rest of Mastercard’s 90 million merchant network around the world (global rollout date has not been released).

Coinbase partnership with BlackRock enables more institutional clients to buy bitcoin.

BlackRock is the largest asset manager in the world with more than $8 trillion under management.

“Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets,”

Coinbase currently services over 13,000 institutional clients, which include hedge funds, asset allocators, financial institutions, corporate treasuries and other institutions.

“The first domino fell when Fidelity allowed bitcoin investing in their 401(k)s. Now with Blackrock and Coinbase, the second domino has fallen - hence the institutions are lining up for massive adoption in both the technology and currency…”

What We’re Listening To

Full Send Podcast with Bored Ape Founders: Bored Ape Yacht Club Creators Explain How Steph Curry & Bieber Got Their NFT & How BAYC is Worth $4B

What Bitcoin Did with Lyn Alden: Eurodollar & The Money Printer

Real Vision with the Global Director of Macro for Fidelity Investments: Jurrien Timmer Explains Why Crypto Is Macro

Where it Happens with Raoul Pal: Investor Psychology & Trading on the Future

Coinbase Around the Block: Brian Armstrong & Vitalik Buterin Discuss Decentralization, Privacy and more

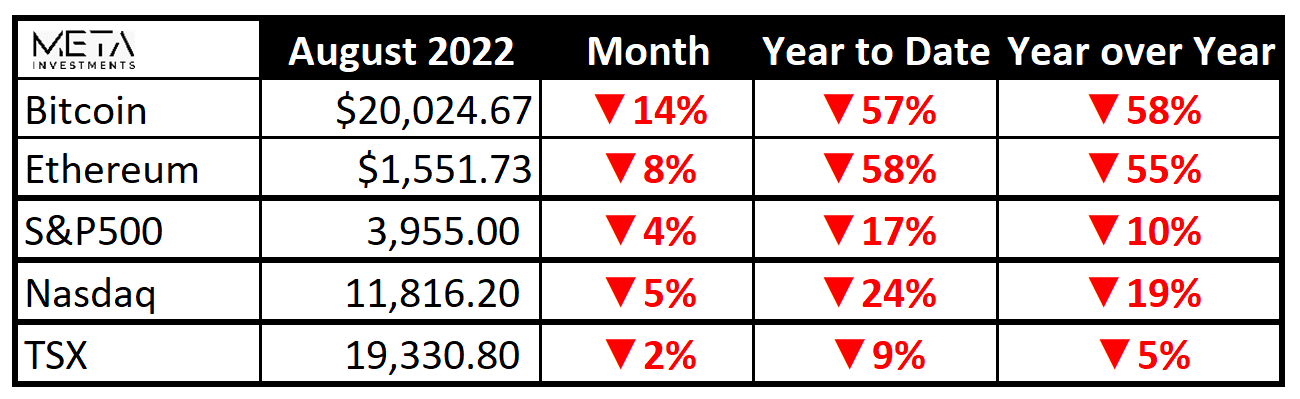

Market Update [August 2022].

Financial markets were meaningfully lower at the end of August 2022.

However, this snapshot represents an arbitrary point in time since buying/selling can occur anytime during the month.

We use the term anytime loosely since time / permissions currently depend on the asset class.

Public equities and cryptocurrency tokens are liquid, which means they can be bought or sold during market hours.

For North American public equities, anytime for general retail investors means 9:30am ET to 4pm ET from Monday to Friday (except public holidays).

BUT sophisticated traders/investors have extended access to trading versus general retail investors:

a) pre-market can begin as early as 4am ET.

b) after-market can go as late as 8pm ET.

*Sophisticated traders / investors in public equities have access to better hours / opportunities than retail investors*

For global cryptocurrencies, anyone with an internet connection located anywhere can buy / sell tokens 24hrs a day, 7 days a week, 365 days a year (+1 day on leap years!).

i.e. anytime means… anytime.

*Sophisticated traders / investors in cryptocurrencies have access to the same hours / opportunities as retail investors*

Rather than select the last day of the month, we examined equities and cryptocurrencies within the month of August, which reveals a very different story than the end of August.

Markets peaked in mid-August.

August 15th vs. July 31st (vs. August 31st):

S&P500: up 9% (vs. down 4%)

Nasdaq: up 11% (vs. down 5%)

TSX: up 5% (vs. down 2%)

Even more impressively, Bitcoin and Ethereum were up materially in mid-August.

August 15th vs. July 31st (vs. August 31st):

Bitcoin: up 20% (vs. down 14%)

Ethereum: up 23% (vs. down 8%)

We do not time markets at Meta Investments.

Our strategy uses proprietary trading algorithms with sophisticated stop loss functions that allow gains to accrue on the upside and protect for losses on the downside while monitoring for macro risk premium.

In simple terms, we buy and hold for the upside. On the other hand, we sell when liquid investments move in the opposite direction to realize gains. Following a sale, we analyze the right time to re-purchase investments by studying the floor and looking for strengthening conditions. This strategy also takes into account other macro economic factors.

Meta Investments maintains that Bitcoin and Ethereum will play a prominent role in our increasingly digitally native future.

We remain very bullish on the investment opportunity that blockchain + cryptocurrencies represent, especially at these levels.

NFTs Continue To Go Mainstream

NFTs moved from the virtual to physical world in the month of August.

The Bored Ape Yacht Club (“BAYC”) appeared on limited edition M&Ms to melt in your mouth, not your hands.

These new M&Ms from Kingship featuring BAYC NFTs are available for purchase in the United States on M&Ms’ official website.

Kingship is a supergroup of 3 Bored Ape Yacht Club NFTs + 1 Mutant Ape Yacht Club NFT and shares the same manager as Snoop Dogg.

M&Ms (and parent company Mars Inc.) isn’t the only famous company embracing Web3 brands.

In August, Tiffany & Co. embraced CryptoPunks via exclusive wearable jewelry known as NFTiff: a collection of 250 NFTs launched on August 5th.

The mint price (or “cost”) was 30 ETH = $50,000 per item at the time of launch.

The collection sold out in 20min and generated $12.5 million in revenue for Tiffany & Co.

Each NFTiff offers CryptoPunk NFT holders the right to receive a personalized custom pendant containing gemstones and diamonds.

Note: Yuga Labs is the Parent Company for both Bored Ape Yacht Club and CryptoPunks.

The luxury fashion industry has embraced NFTs more rapidly and passionately than other sectors, and web3 will likely play a meaningful part in its future.

Both high-fashion and NFTs operate on notions of exclusivity and scarcity, which help explain the industry’s openness to web3 compared to other conventional businesses (that have hesitantly begun to experiment with it):

Refer to the following article for more on big brands embracing NFTs: 10 Big Brands That Recently Joined the NFT Space

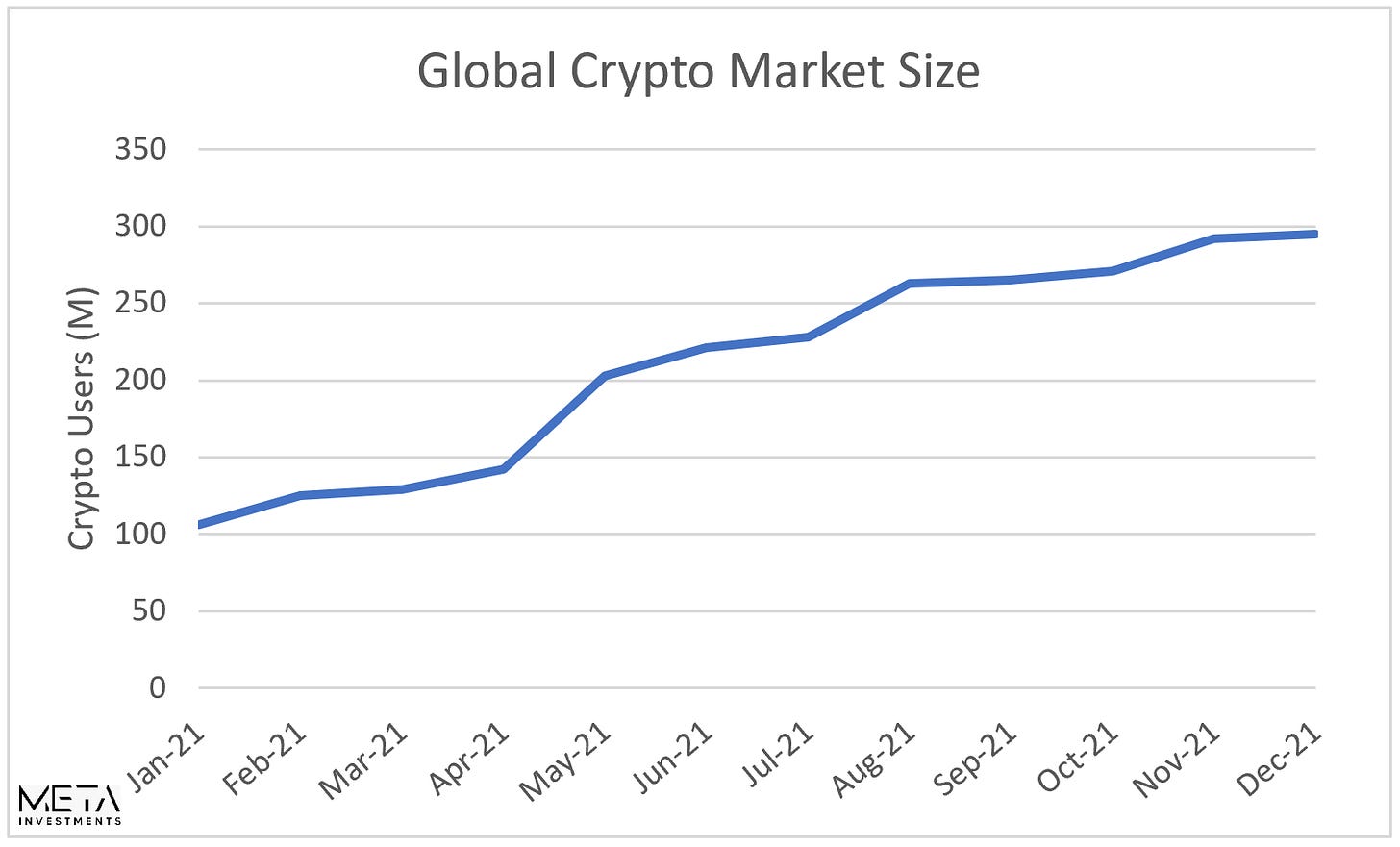

Meta Investments continues to believe (based on objective facts) that we are seeing the early stages blockchain/crypto adoption, including NFT adoption, as discussed in our March newsletter:

We continue to witness extreme growth as the user-base grew ~3x in 2021: 106 million to 295 million according to crypto.com.

Estimates suggest that ~16% of adult Americans have invested in, traded, or used cryptocurrencies.

In other words: We. Are. Early.

We remain optimistic about the impact that blockchain technology will have on virtually all aspects of our lives.

We also remain optimistic about value that will accrue to investors within this asset class.