Meta Investments News (March 2022)

Meta Investments News is a monthly newsletter sent to our investors and supporters.

Top News/Articles for March 2022

President Biden’s Executive Order on Digital Assets

(Discussed Below)Bored Ape Yacht Club Parent Co. (Yuga Labs) acquires CryptoPunks

(Discussed Below)

President Biden’s Executive Order on Digital Assets.

The regulatory cloud floating over the crypto industry has been building for years. The uncertainty has led many to remain on the sidelines awaiting clarity and guidance.

US President Joe Biden signed an Executive Order in March calling on the Government to examine the risks and benefits of cryptocurrencies.

Leading up to this Executive Order, many believed that the United States would outright ban cryptocurrencies - similar to President Franklin D. Roosevelt "forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States” via Executive Order 6102 in 1933.

Following 1933, individuals that held gold were subject to a penalty of $10,000 and/or 5-10 years imprisonment until Executive Order 6102 was repealed in 1974 (i.e. 41yrs later!).

President Biden’s Executive Order (Summary Fact Sheet) sheds a positive light on crypto:

“The rise in digital assets creates an opportunity to reinforce American leadership in the global financial system and at the technological frontier…”

“The United States must maintain technological leadership in this rapidly growing space, supporting innovation…”

The crypto industry surfaced in 2008 and reached a high of $3 trillion in November 2021. It is understandable to see price volatility in any asset undergoing extreme growth.

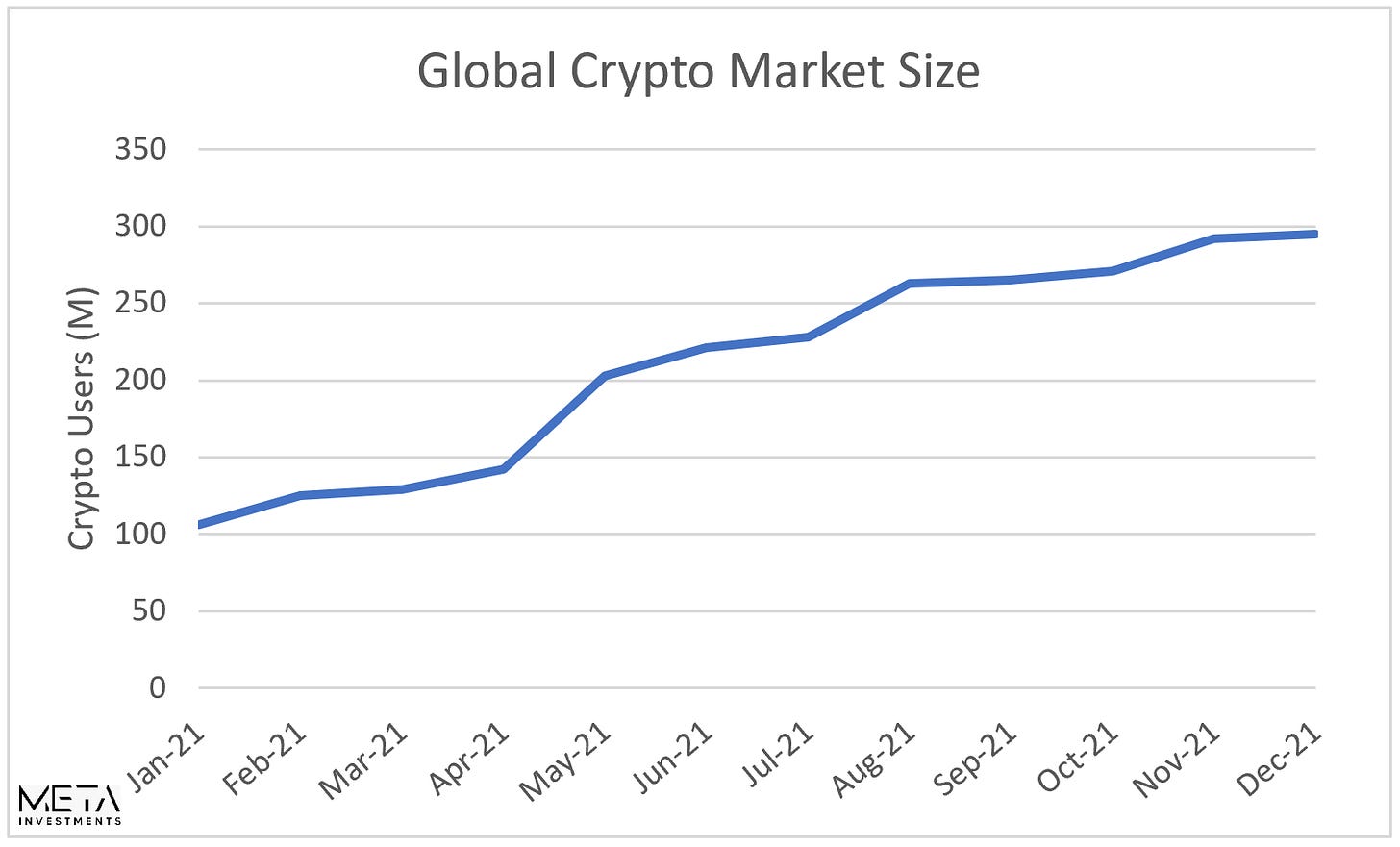

We continue to witness extreme growth as the user-base grew ~3x in 2021: 106 million to 295 million according to crypto.com.

Estimates suggest that ~16% of adult Americans have invested in, traded, or used cryptocurrencies.

In other words: We. Are. Early.

We remain optimistic about the impact that blockchain technology will have on virtually all aspects of our lives.

We also remain optimistic about value that will accrue to investors within this asset class.

Bored Ape Yacht Club acquires CryptoPunks.

Apes buying Punks is considered a major consolidation within the NFT world.

The top two properties now sit under the same parent company Yuga Labs, which completed its $450 Million Seed financing round in March at a valuation of $4 Billion.

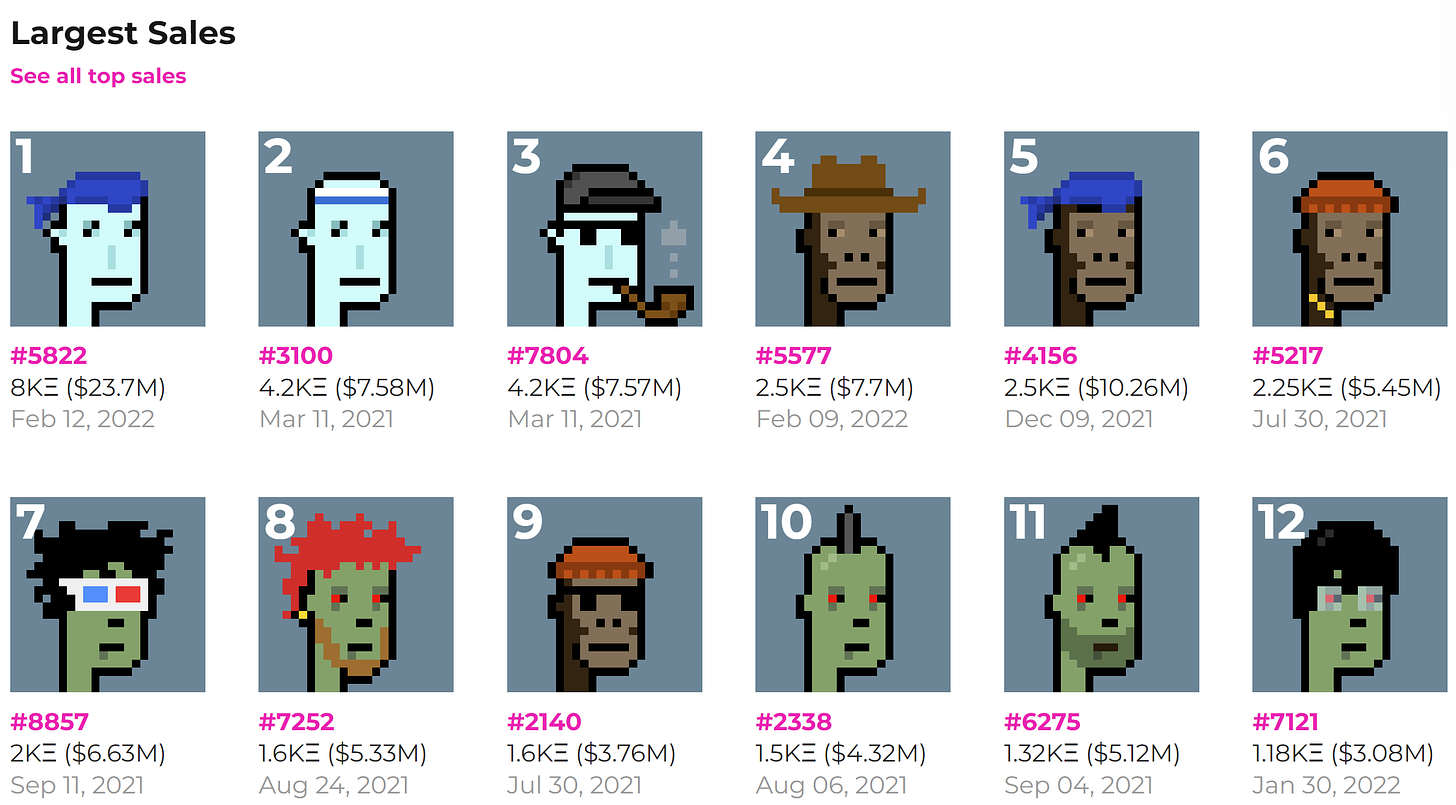

CryptoPunks

CryptoPunks were created in 2017 and the collection consists of 10,000 24x24 pixel images. It is considered one of the earliest Non-Fungible Token (“NFT”) projects on the Ethereum network and is the inspiration for the NFT standard that powers most digital art and collectibles (ERC-721).

Believe it or not, a number of Punks have sold for $ millions. The most expensive fetched ~$24M in February 2022.

Bored Ape Yacht Club

The Bored Ape Yacht Club (“BAYC”) was conceived on February 1, 2021 and officially launched on April 23, 2021 (less than a year ago!).

The cost to acquire (or “mint”) a BAYC NFT at inception was .08 ETH or the equivalent of ~$200.

As at March 31, 2022, the cheapest (or “floor”) BAYC NFT according to the leading NFT marketplace OpenSea was 110.69 ETH or the equivalent of ~$360,000.

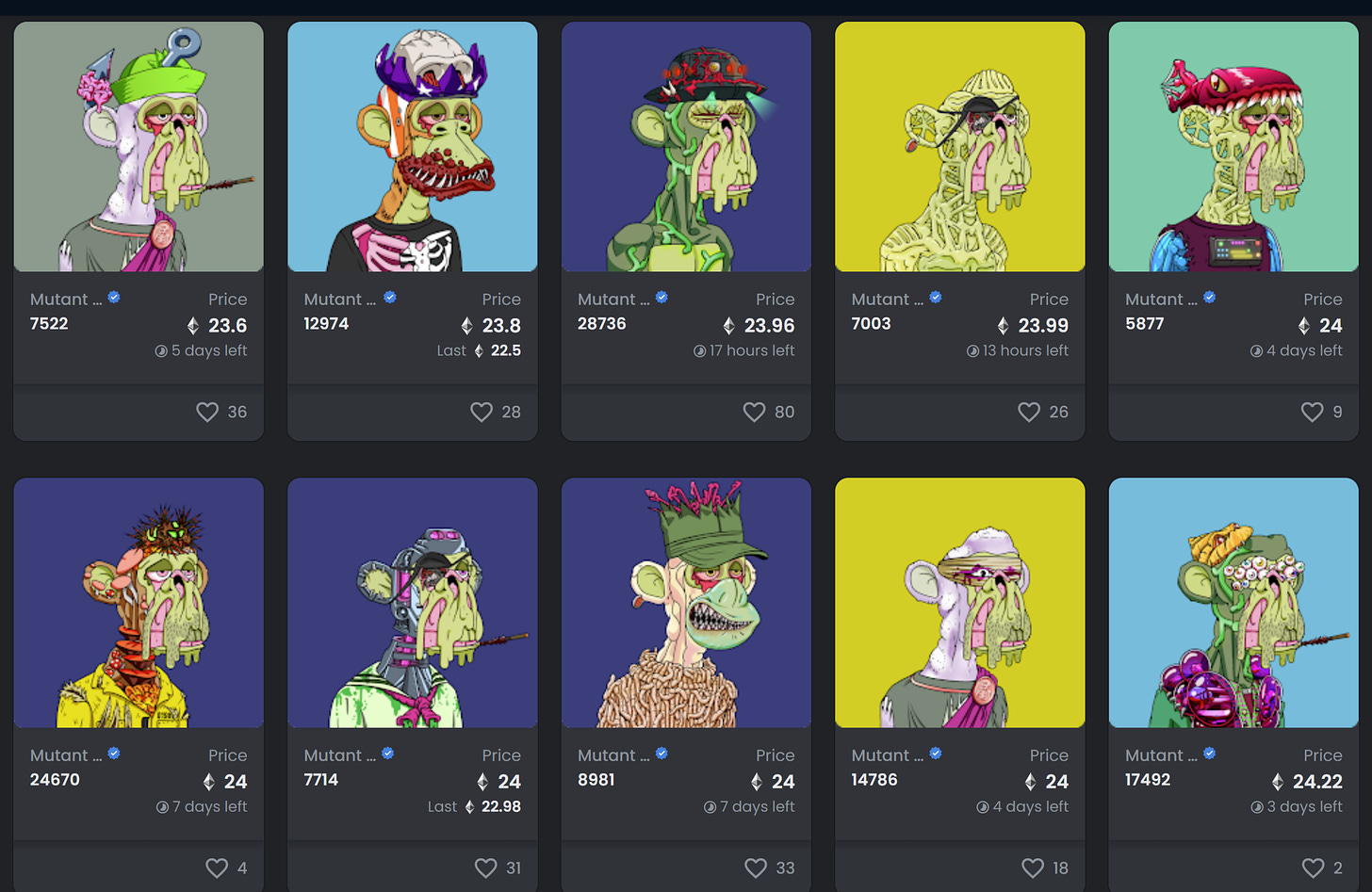

Not only did early investors see their NFT skyrocket in price, each holder was gifted (or “air dropped”) a Mutant Ape (“MAYC”) for free!

As at March 31, 2022, the floor MAYC NFT according to OpenSea was 23.6 ETH or the equivalent of ~$80,000.

But wait… there’s more!!

BAYC and MAYC holders were also air dropped $APE tokens in March worth over $100K and $20K, respectively. (Tweet announcing $APE Token)

Investment Summary:

(A) April 2021: ~$200 invested

(B) March 2022: ~$550,000 value

We don’t know what the future holds for this NFT community, but we expect it to remain very interesting:

Why do Apes matter? The following article - by a great macro commentator and investor that we follow - explains why investors and celebrities continue to “Ape into” the Bored Ape Yacht Club: The Monkey Network.

March Cryptocurrency Market Update

Cryptocurrencies are generally viewed as a risky asset class. When equity markets correct, cryptocurrencies typically see deeper declines as investors aim to "protect" themselves through defensive cash positions.

We saw a surprisingly positive market in March despite pervasively negative headlines: ongoing record inflation, US Fed increasing interest rates, war in Europe, runaway oil prices, and more:

Inflation Dominates Americans' Economic Concerns in March

“Roughly one in five Americans mention the high cost of living/inflation (17%), or fuel prices (4%) specifically, as the most important problem facing the U.S. today.”

“This increase in concern comes as the U.S. inflation rate continues to climb, and is now at its highest point in 40 years.”

“Americans' outlook for the economy is now about tied with the most negative it has been since the early days of the pandemic in April 2020.”

The Federal Reserve raised interest rates for the first time since 2018

“The Federal Reserve on [March 16, 2022] raised interest rates for the first time since 2018 and laid out an aggressive plan to push borrowing costs to restrictive levels next year in a pivot from battling the coronavirus pandemic to countering the economic risks posed by excessive inflation and the war in Ukraine.”

“Most policymakers now see the federal funds rate rising to a range between 1.75% and 2% by the end of 2022, the equivalent of a quarter-percentage-point rate increase at each of the Fed's six remaining policy meetings this year.”

Equities are (generally) priced by discounting expected future cash flows to time zero (i.e. today) using a discount rate. An increase in interest rates results in an increase in the discount rate used to present value future cash flows. A higher discount rate leads to a lower present value of future cash flows. Lower present value of cash flows divided by same shares outstanding = lower price per share.

“Markets can remain irrational longer than you can stay solvent.”

- John Maynard Kanyes.

Despite negative headlines, we witnessed a buoyant month of March for both equities and cryptocurrencies:

Bitcoin: up 6%

Ethereum: up 13%

S&P500: up 4%

NASDAQ: up 3%

TSX: up 4%

Bitcoin's association with "digital gold" continues to strengthen. It possesses a lot of the positive qualities of money (refer to next article) and combines the scarcity and durability of gold in addition to the use, storage and transportability of fiat (even improving on it).

Ethereum is distinctly different than Bitcoin. It is a platform that powers decentralized applications that everyone can use and no one can take down.

We believe that Bitcoin and Ethereum will play a prominent role in our increasingly digitally native future.

We remain very bullish on the opportunity that blockchain + cryptocurrencies represent, especially at these price levels.

Lyn Alden: What is Money, Anyway?

(click above + summarized in thread)

Arthur Hayes: Energy Cancelled.

(click above + summarized in thread)