Meta Investments News (September 2022)

Meta Investments News is a monthly newsletter sent to our investors and supporters.

Top News/Articles for September 2022

September Cryptocurrency Market Update.

(Discussed Below)Ethereum: 99.5% Less Energy, Offers Yield, Disinflationary Issuance,…

(Discussed Below)Building On Top Of Bitcoin: A Look At The Lightning Network.

(Discussed Below)Biden White House Framework on Regulating Crypto.

The first-ever framework on what crypto regulation in the U.S. should look like was released last month.

including ways financial services industry should evolve to make borderless transactions easier, and how to crack down on fraud in the digital asset space.

The framework follows an executive order issued in March, in which President Joe Biden called on federal agencies to examine the risks and benefits of cryptocurrencies and issue official reports on their findings.

Fighting illicit finance: evaluate whether to call upon Congress to amend the Bank Secrecy Act.

New kind of digital dollar: points to the potential for “significant benefits” from a U.S. central bank digital currency (“CBDC”).

Safeguarding financial stability: single out stablecoins, warning that they could create disruptive runs if not paired with appropriate regulation.

BCG: Relevance of on-chain asset tokenization in ‘crypto winter’.

Tokenization of global illiquid assets estimated to be $16 Trillion business opportunity by 2030.

Despite the crypto crash and funding outlook, developer activity has continued to hold strong, indicating a resilient talent pool.

On-chain asset tokenization is one blockchain-based application with the potential to dramatically unlock liquidity, access and choice for multiple investment instruments at scale, especially for those assets that are traditionally illiquid (e.g. real estate, high-value art, public infrastructure, private equity).

Key reasons for asset illiquidity include a) limited affordability; b) inability to fractionalize inherent utility; c) lack of information to retail/high net-worth individual investors; d) limited access; e) regulatory hurdles; f) complex user journeys for obtaining access; and g) lack of existing, scaled technological solutions to unlock liquidity in such assets.

Higher inflation = strong money and credit growth, strong demand and economic growth, declining unemployment.

Disinflation (or deflation) happens when the opposite is true.

The process starts with inflation then it goes to interest rates, then to other markets, and then to the economy.

Spiral: people become cautious when they lose money and lenders are cautious lending to them = less spending and more cautious....

Ray Dalio believes (1) inflation will stay significantly above what people and the Fed want it to be; (2) interest rates will go up; (3) other markets will go down; and (4) the economy will be weaker than expected.

What We’re Listening To

Bankless with Morgan Housel: The Psychology of Crypto

Empire with Zaki Manian and Jack Zampolin: The Cosmos App-Chain Thesis

Founders Podcast: Steve Jobs In His Own Words

All-In Podcast: Big tech starts making cuts, Fed incompetency, global debt, Russia/Ukraine & more

September Cryptocurrency Market Update.

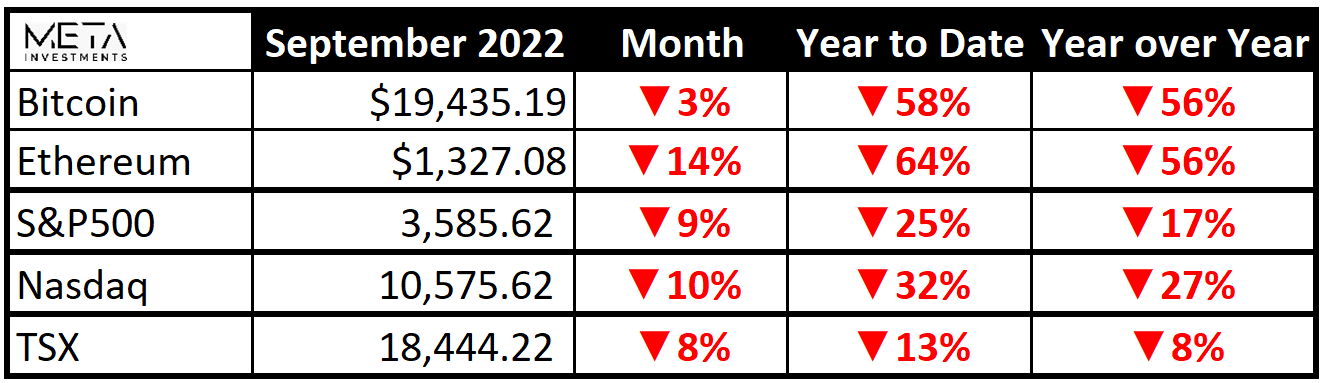

Financial markets experienced (yet) another difficult month in September.

It’s safe to say that we’re no longer in a bubble.

We are certainly not feeling last year’s euphoric highs with the S&P500 down 1/4 and Nasdaq down ~1/3 year-to-date.

Interestingly, Bitcoin “lost less” in September than equity markets.

Are we at the bottom? Probably not.

However, it may be time to ask: should I start averaging into solid investments at attractive valuations?

US Central Bank took its federal funds rate between 3%-3.25%, which is the highest since early 2008.

September was the 3rd consecutive 0.75 percentage point move.

Interest rate increases started in March — from near-zero — marking the most aggressive Fed tightening since it started using the overnight funds rate as its principal policy tool in 1990.

Only comparison is 1994 when the Fed hiked 2.25% (it would begin cutting rates by July of the following year).

Stanley Druckenmiller — widely regarded as one of the greatest macro investors — sent a stern warning to investors this past month.

“We’re getting to the point now where the interest expense on the debt is so high that it’s going to eat up our ability to basically service the next generation, and I’m not even sure about the current one.”

“I will be stunned if we don’t have a recession in ’23. Don’t know the timing, but certainly by the end of ’23… I’ve been wrong on a lot of things. I could be wrong on this, but since I do it for a living, that’s our forecast, which is a recession in ’23.”

“I don’t own Bitcoin.”

BUT

“I could see crypto currency having a big role in a Renaissance because people just aren’t going to trust the central banks.”

Uncertainty breeds opportunity.

For investors looking at opportunities, below is a short list of successful startups founded during 2008 Great Recession:

Cloudera, 2008 (acquired in '21 for $5.3B)

WhatsApp, 2009 (acquired by Facebook in '14 for $19B)

Slack, 2009 (acquired by Salesforce in '21 for $28B)

Uber, 2009 ($52B valuation)

Square, 2009 ($32B valuation)

Instagram, 2010 (acquired by Facebook in 2012 for $1B)

Pinterest, 2010 ($15B valuation)

Bitcoin was created in 2009.

It is currently valued at $370B with recent 24hr volume of $37B.

Bitcoin has ushered in a wave of innovation based on a digital system for recording the transaction of assets recorded in multiple places at the same time = Distributed Ledger Technology (“DLT”).

Distributed ledgers use independent computers (“nodes”) to record, share and synchronize transactions in their respective electronic ledgers, instead of keeping data centralized like a traditional ledger.

Bitcoin led to the creation of Ethereum in 2013.

Ethereum is currently valued at $160B with recent 24hr volume of $10B.

Ethereum is a blockchain with a computer embedded in it:

Anyone who is on the network has permission to use the service – or in other words, permission isn't required.

No one can block you or deny you access to the service.

Ethereum is turing-complete, meaning you can program pretty much anything.

Meta Investments maintains that Bitcoin and Ethereum will play a prominent role in our increasingly digitally native future.

We remain very bullish on the investment opportunity that blockchain + cryptocurrencies represent, especially at these depressed levels.

Ethereum: 99.5% Less Energy, Offers Yield, Disinflationary Issuance,…

On September 15, 2022, Ethereum successfully transitioned its network consensus from Proof-of-Work to Proof-of-Stake.

Ethereum no longer requires intensive energy via “mining” to secure its network.

Mining is often criticized for being environmentally unfriendly due to its energy demands to secure the network.

(note: ARK and Square - now Block Inc. - produced the following whitepaper suggesting mining encourages the adoption of renewable energy and isn't environmentally-damaging: Bitcoin is Key to an Abundant, Clean Energy Future)

Through the move to Proof-of-Stake, Ethereum energy consumption has been reduced by ~99.95%!!

What is network consensus?

Consider a group of people going to dinner. Consensus is achieved if there is no disagreement on a proposed restaurant.

If there is disagreement, the group must have the means to decide where to eat. In extreme cases, the group will eventually split.

Proof-of-Stake underlies certain consensus mechanisms used by blockchains to achieve distributed consensus

Ethereum now uses a consensus mechanism that derives its crypto-economic security from a set of rewards (or penalties) to deposited Ethereum tokens ($ETH).

This process is known as “staking”.

This incentive structure encourages individual stakers to operate honestly while punishing those who are dishonest by creating an extremely high cost (/barrier) to attack the network.

Proof-of-Stake comes with a number of improvements to Ethereum’s proof-of-work system:

better energy efficiency: no need to use material energy on computation.

lower barriers to entry / reduced hardware requirements: no need for [elite] hardware to create new blocks.

reduced centralization risk: proof-of-stake should lead to more access points (or “nodes”) securing the network.

less ETH issuance: low energy / capital required to participate = lower requirement to distribute meaningful amounts of $ETH as incentive.

economic penalties for misbehaviour: 51% style attacks exponentially more costly for an attacker compared to proof-of-work.

more…

If an Ethereum validator intentionally defies network rules then their staked $ETH is “slashed”.

In other words, a portion of their staked ETH is taken away and in some situations, the entire staked sum of 32 ETH is withdrawn.

Ethereum token issuance is also down materially.

Token issuance previously originated from two places:

Mining rewards: ~13,000 ETH/day.

Staking rewards: ~1,600 ETH/day (at current staked ETH levels).

Following “The Merge”, mining rewards were eliminated.

The Merge dramatically cut Ethereum token issuance by ~90% (13,000 / 14,600) and the annual $ETH issued went from ~2.5% inflationary to 0.2%.

Issuance is expected to become deflationary as network (and token) demand increases.

$ETH Tokens committed to Proof-of-Stake currently earn a yield of ~5%.

This yield / return on $ETH will adjust up or down depending on network activity and supply of $ETH staked.

For more info on staking rates and providers refer to Staking Rewards.

Please refer to our write-up from July for more discussion on Ethereum: What is it and Is the Upcoming Merge a “Generational Investment Opportunity”?

Building On Top Of Bitcoin: A Look At The Lightning Network.

(summary of Lyn Alden’s article)

A truly decentralized and permissionless payment network requires its own underlying self-custodial digital bearer asset.

In order to create a truly new digital bearer asset that is useful for payments in the long run, it must also be an attractive store of value, so that a meaningful percentage of the population begins to persistently hold it as some percentage of their liquid net worth and be willing to accept it for goods and services.

Bitcoin started with a smart design from the beginning.

Bitcoin created an underlying digital gold and settlement network, with a credible degree of decentralization, auditability, scarcity, and immutability that no other network currently rivals.

Volatility is inevitable along the path of monetization.

A new money cannot go from zero to trillions without upward volatility by definition.

Upward volatility comes with speculators, leverage, and periods of downward volatility.

The first decade or two of monetization for the network - as it undergoes open price discovery to reach the bulk of its total addressable market - should be different than the "steady state" of the network after it reaches the bulk of its total addressable market, assuming it is successful in doing so.

Every successful financial system uses a layered approach, with each layer being optimal for a certain purpose.

Fedwire is the gross settlement system between banks in the US.

Fedwire currently does <20 million transactions per month (~200 million per year) but settles >$80 trillion in value per month (nearly $1 quadrillion per year) because the average transaction size is massive and each of these settlements represents a batch of many smaller payment transactions.

We as consumers don't directly use that system.

Instead, we use payment methods like credit cards, debit cards, PayPal, electronic cheques, and so forth. Our banks record those transactions on their ledger and then settle between each other later.

i.e. each Fedwire transaction represents a batch of tons of smaller transactions from higher layers.

In short, the path to a robust and healthy financial network includes (1) core settlement system; and (2) layers on top of it for more throughput, capable of settling billions of transactions per month.

Bitcoin's ecosystem has evolved in a similar way, except in an open and peer-to-peer manner.

Bitcoin's base layer has the capacity to process up to ~400,000 transactions per day resulting in up to 1 million+ individual payments per day.

That's tens of millions of payments per month, or hundreds of million payments per year, which is what Fedwire currently handles.

The Lightning network consists of a series of smart contract channels that run on top of the bitcoin base layer.

No company controls the Lightning network. It's an open source set of participants.

For thousands of years, commerce and money moved at the same speed: the speed of foot, horses, and ships.

With the invention of the telegraph then the telephone and undersea cables throughout the 1800s, the speed of commerce increased to nearly the speed of light. People could transact across continents by updating each other's bank ledgers over telecommunication systems.

However, gold and silver as bearer assets still moved slowly and thus had to be increasingly abstracted in order to keep up.

The invention of the Bitcoin network, and in particular the Lightning network that makes use of it, re-created a way for bearer assets to move at the speed of telecommunications, just like commerce does.

At the end of the day, blockchains are information.

Users are merely updating an open source distributed public ledger amongst themselves, and can simply memorize a twelve-word seed phrase to interact with it.

To outright ban the individual use of open source blockchain software, is basically to ban a form of speech and information.

The Bitcoin/Lightning stack in particular continues to be very promising as a monetary network with ongoing signs of user adoption and development, along with high levels of decentralization.

It's not without risks and challenges, but it's certainly something to keep an eye on.