Meta Investments News (October 2022)

Meta Investments News is a monthly newsletter sent to our investors and supporters.

Top News/Articles for October 2022

October Cryptocurrency Market Update.

(Discussed Below)How We Onboard Billions to Web3

(Discussed Below)Web3 Developer Report

(Discussed Below)Custodian bank: financial institution that holds its clients' securities (stocks, bonds) and offers asset protection for safekeeping to prevent them from being stolen or lost.

The oldest bank in the U.S., will allow fund managers to safeguard digital assets such as Ether and Bitcoin holdings.

Recent survey from BNY Mellon revealed (1) 91% of institutional investors are interested in digital assets; and (2) 41% of institutional investors hold crypto in their portfolios.

Select group of clients storage of keys required to access and transfer their digital holdings and bookkeeping services similar to stock, bonds, and commodities.

Hong Kong Plans to Legalize Retail Crypto Trading to Become Hub

Hong Kong will start a consultation on legalizing crypto trading by retail investors as it seeks to create a hub for digital tokens under a wider push to restore the city’s credentials as a financial center.

“A consistent framework for crypto regulation is essential and key to growing institutional and retail adoption of digital assets at scale.”

Fidelity’s Crypto Arm to Provide ‘Institutional Ethereum Capabilities’

Institutional clients will be able to buy, sell, and transfer ETH.

Numerous investors have started seeing ETH “through a new [positive] lens” after the Merge was officially completed (refer to our discussion on The Merge from last month).

Europe Finalizes Landmark Crypto Rules After 2 Years of Debate

Agreed on final wording for landmark crypto legislation to pave the way for a Europe-wide regulatory approach.

Issuers of stablecoins subject to specific capital requirements and hold reserves to back up the value of their tokens in an amount proportional to how much is issued.

Note: NFTs and decentralized finance (“DeFi”) are excluded from the scope.

Bored Ape Yacht Club tell all: The untold story of the $4 billion crypto startup

Formed in February 2021.

Company’s success and direction are primarily the product of just four people.

Racked up $100 million in profit in its first year + raised $450 million in seed funding (valuing company at $4 billion).

Future ambitions are unknown.

NFTs = ownership of underlying Bored Ape and the art.

Interpreted as owners having IP rights to develop their own creative businesses based on their ape.

Goal: build a company with iconic IP assets that it monetizes across interrelated network of games, books, movies, and shows.

More to come: “The reality is, we’re kind of bored of low-effort stuff.”

What We’re Listening To

Real Vision Daily Briefing: What Kind of Hike Was It?

US Senate Banking, Housing and Urban Development Committee hearing on Cryptocurrency (2018): Van Valkenburg explains Bitcoin.

Unchained with Do Kwon of Terra: It Was Never Really About Money or Fame or Success.

The Investor’s Podcast: Down But Not Out W/ Cathie Wood.

What Bitcoin Did with Nic Carter: The White House is Wrong About Bitcoin Mining.

Lex Fridman with Balaji Srinivasan (8hrs!): How to Fix Government, Twitter, Science, and the FDA.

What We’re Watching

COIN: A Founder's Story (Coinbase Documentary)

Trust No One: The Hunt for the Crypto King (Quadriga Story)

October Cryptocurrency Market Update.

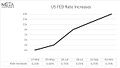

Financial markets were up in October.

The best guess as to the reason markets went up last month is that investors were looking forward and anticipating a “Fed Pivot” - i.e. slowdown of Quantitative Tightening (explained in our May Newsletter).

However, interest rates went up… yet again.

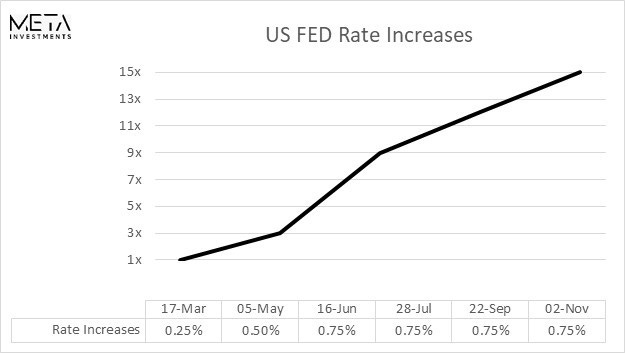

The United States increased rates by another 75 basis points (or 0.75%) on November 2nd and included commentary that it was “very premature” to discuss when the Fed might pause its increases (link to Reuters article).

This is the 6th increase in 2022 with interest rates up 15x since March = the fastest rate of change in 40yrs(!)

A dramatic increase in rates leads to a dramatic increase in costs to service debts.

Example: 1% interest rate increase on $300,000 30-year, fixed-rate mortgage.

Interest rate of 3.5%.

Total lifetime mortgage of ~$485,000.

Interest charges = $185,000.

Monthly payments = $1,340.

Interest rate increased by 1% to 4.5%.

Total lifetime mortgage >$547,000.

Interest charges = $247,000.

Monthly payment = $1,520.

Note: rates have increased 3.75% (so far…).

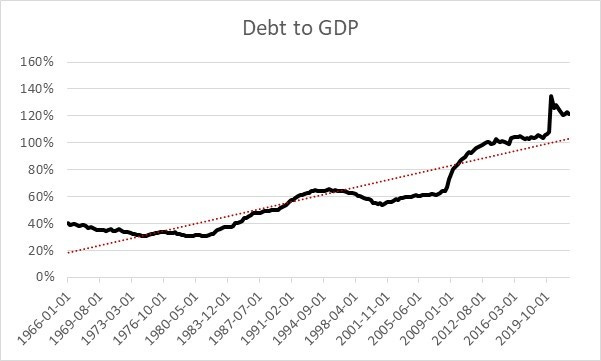

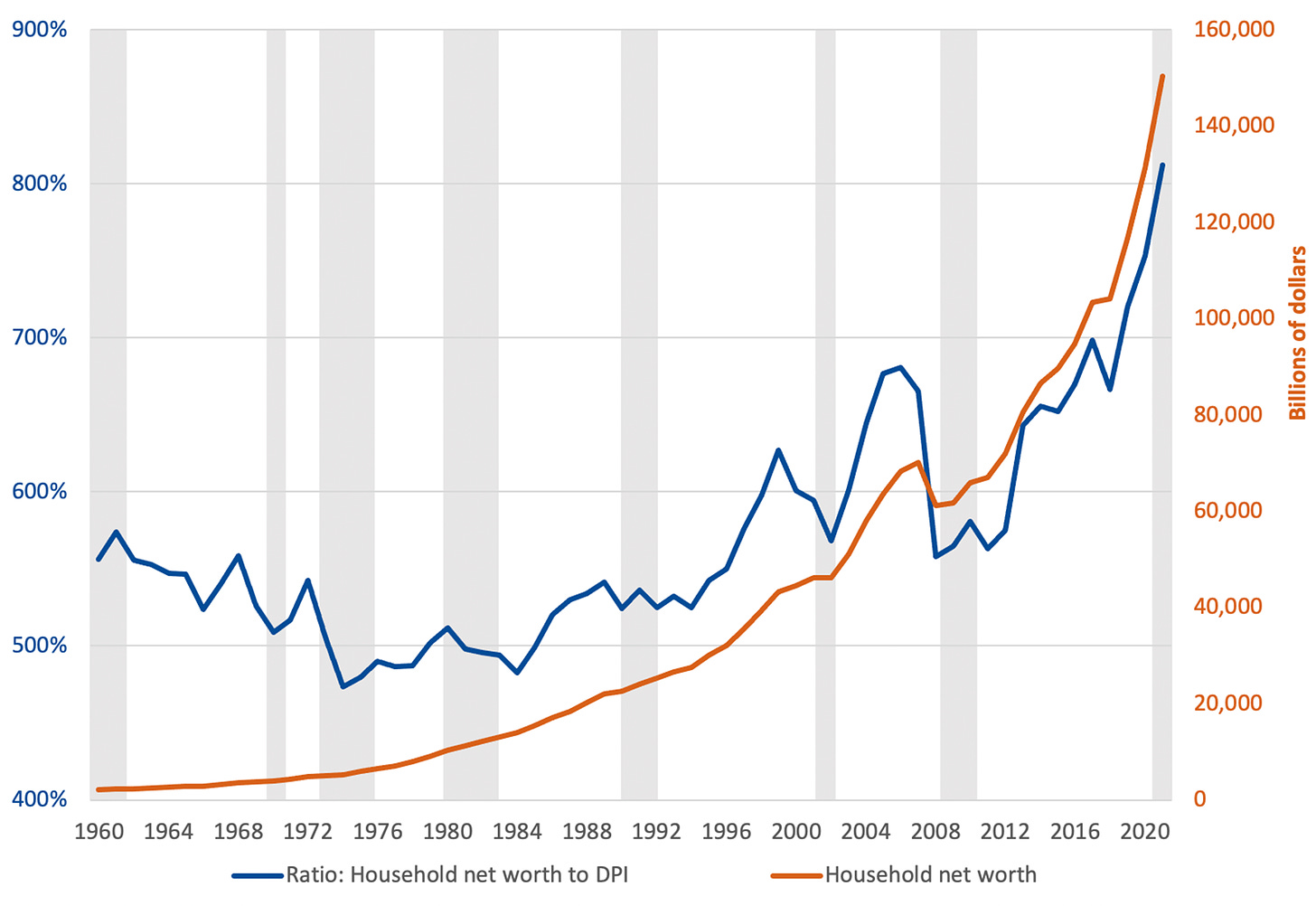

Looking back at the past 50 years within the United States, we see debt increasing much faster than the production of goods and services or gross domestic product (“GDP”).

This reveals that economic growth has been fueled by debt.

Debt allows people/companies/governments to invest today with the expectation of future cash flow and profits.

Cheaper debt allows for more investment and consumption today since the cost to service that debt is low.

Per McKinsey’s 2021 report: Net worth has tripled since 2000, but the increase mainly reflects valuation gains in real assets, especially real estate, rather than investment in productive assets that drive our economies.

Going back further, household wealth in the United States — measured by household assets less liabilities — has risen every year since 1960 except after the dotcom bust in 2002 and Great Recession in 2008.

(refer to orange line below)

Higher interest rates make loans more expensive for both businesses and consumers.

Interest payment consume a relatively larger amount of costs leading to less disposable income.

Those who can’t (or don’t want to) afford the higher payments postpone projects that involve financing.

It simultaneously encourages people to spend less and earn higher interest on savings.

This reduces the supply of money in circulation, which tends to lower inflation and moderate economic activity = cool the economy.

As discussed in our March newsletter, Equities are (generally) priced by discounting expected future cash flows to time zero (i.e. today) using a discount rate. An increase in interest rates results in an increase in the discount rate used to present value future cash flows. A higher discount rate leads to a lower present value of future cash flows.

Lower present value of cash flows divided by same shares outstanding = lower price per share.

Year to Date (through November 3) Performance of Top Technology Companies:

Shopify = (75.5%)

Facebook = (73.6%)

Netflix = (55.3%)

NVIDIA = (54.4%)

Amazon = (46.4%)

Google = (42.4%)

Tesla = (38.9%)

Microsoft = (36.30%)

Uber = (31.5%)

Apple = (21.8%)

At what price do these technology companies make sense given their growth and future cash flows?

Bitcoin and Ethereum are also down 56% and 57%, respectively this year. This is in-line with the aforementioned technology companies.

Bitcoin and Ethereum trade 24 hours a day, 7 days a week and 365 days a year. This means they offer instant liquidity to anyone/anywhere/anytime.

Highly liquid assets are typically the first to sell given the ease of converting to cash.

Meta Investments maintains that Bitcoin and Ethereum will play a prominent role in our increasingly digitally native future.

Despite “short term” movements in markets, we remain very bullish on the investment opportunity that blockchain + cryptocurrencies represent, especially at these depressed levels.

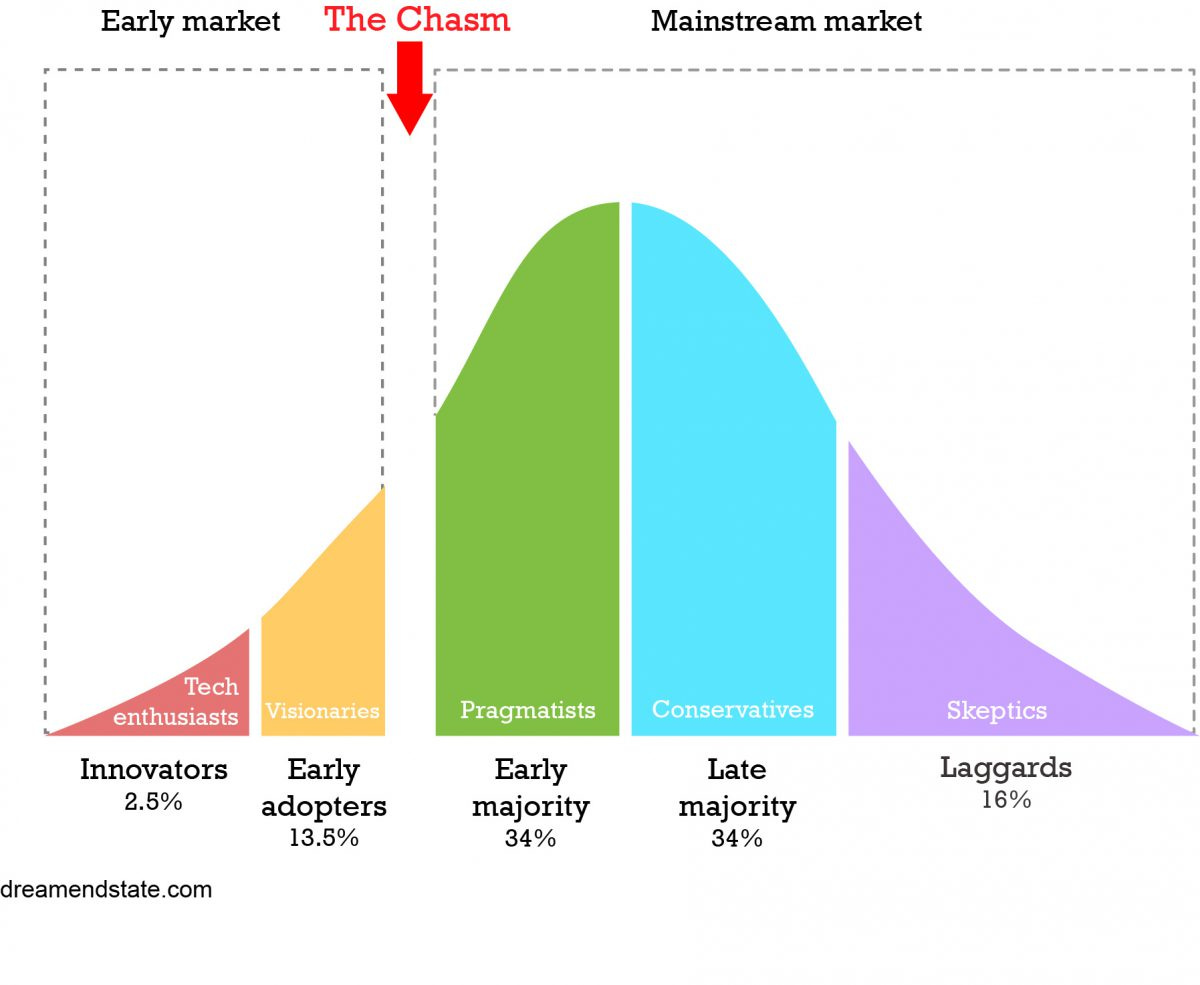

How We Onboard Billions to Web3.

There are 3 key areas we need to focus on to reach mass adoption (excluding time).

Education

Infrastructure

Mentality & Perception Shift.

Education

The learning curve for crypto is steep and treacherous.

It is overwhelming for a newcomer.

Most people do not have a background in technology or cryptography.

Trying to explain what a blockchain is, and how it works, was always going to be a bit tricky.

We can impact the road from here to there. We can make it faster, and smoother.

The more people that understand the potential at hand and how it will improve the world, the better.

Infrastructure

We need far better user experience (UX) and user interface (UI).

Most of the people who were early to this technology were engineers and coders, not designers or user journey experts.

There’s a lot to be desired on the usability side of things.

It is still confusing and convoluted to interact with the Blockchain.

You’re signing transactions with all sorts of jumbled strings of letters and numbers. If you make a mistake, you lose everything.

Code is law, and 99.999999% of humans do not understand the code.

Over the course of the next few decades we’ll go through a generational mentality shift.

Self custodying assets will be normal.

Everyone will understand how powerful it can be to not have to rely on a central bank or an centralized entity.

The same way almost anyone of any age or level of technical knowledge can pull out an iPhone and access the internet and app store and interact with mobile technology, cloud computing, email, and everything else…

We will eventually get to a point when Blockchains are straightforward for anyone to interact with as that.

A Mentality + Perception Shift

Most of “us” in this space need to step out of our bubble and echo chambers and put ourselves in the shoes of someone on the outside looking in.

The reality is that most people are going to lose money trying to trade crypto / NFTs.

The reality is most people are risk averse and don't want to even try.

The most sound strategy for the most people is probably to dollar cost average (“DCA”) into BTC + ETH.

Buy and hold and don't even attempt to swing trade.

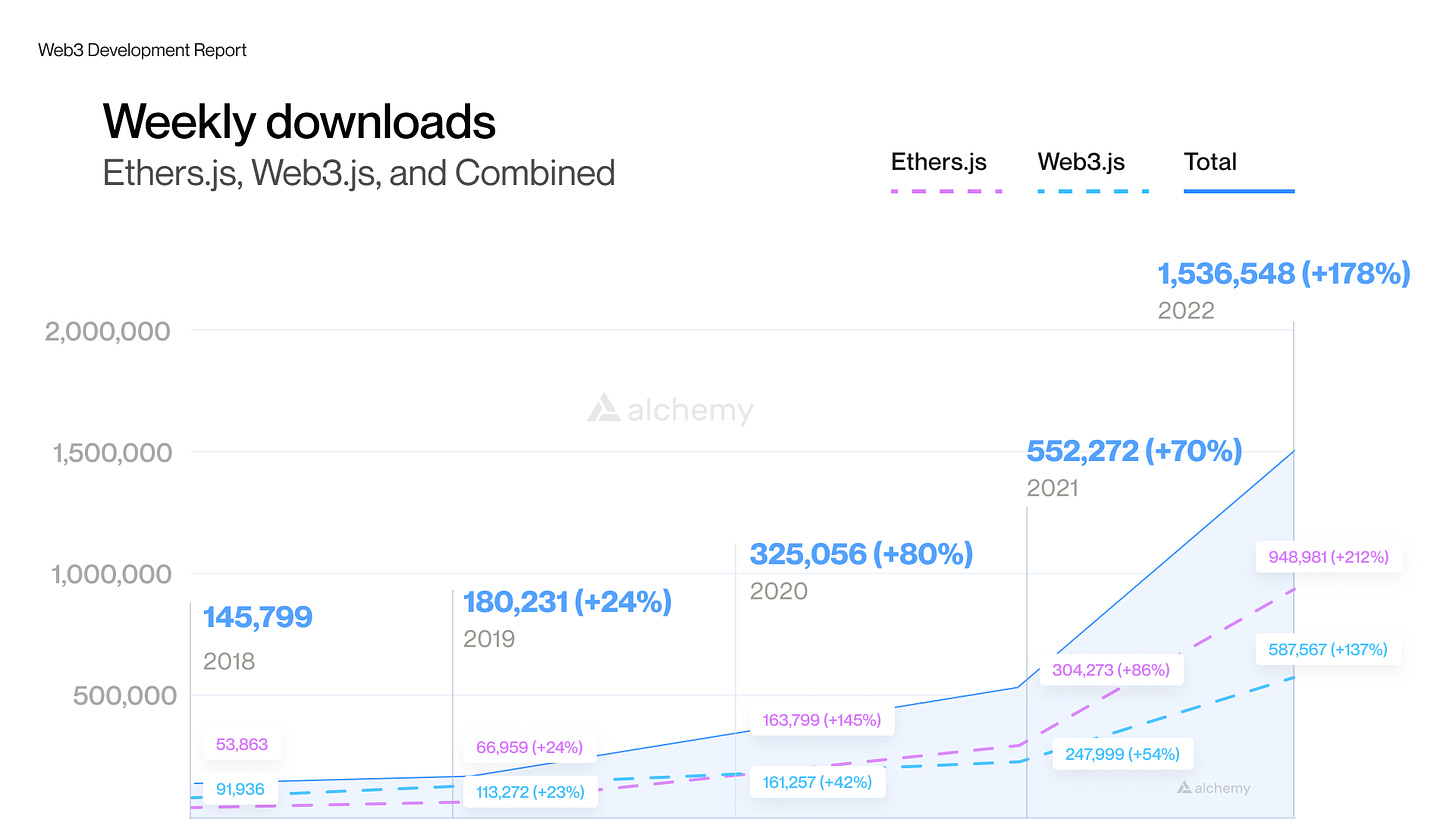

Blockchain Developer Report (Q3 2022)

Although the crypto market capitalization is down about 58% year to date, web3 developers are pouring into the space.

3 ways to measure developer activity:

Libraries: Developer tools to easily read/write to the blockchain.

Smart Contracts: Computer programs stored on a blockchain.

Decentralized Applications (dApps): End-user ready applications with decentralized backends.

These 3 indicators show us that 2022 has been the biggest year for developers building, deploying and growing.

Usage of two critically important web3 libraries (Ethers.js and Web3.js) up 10x in 4yrs:

2018: 145,799

2019: 180,231 (+24%)

2020: 325,056 (+80%)

2021: 552,272 (+70%)

2022: 1,536,548 (+178%)

This metric alone points to a large and growing interest in building applications on Ethereum.

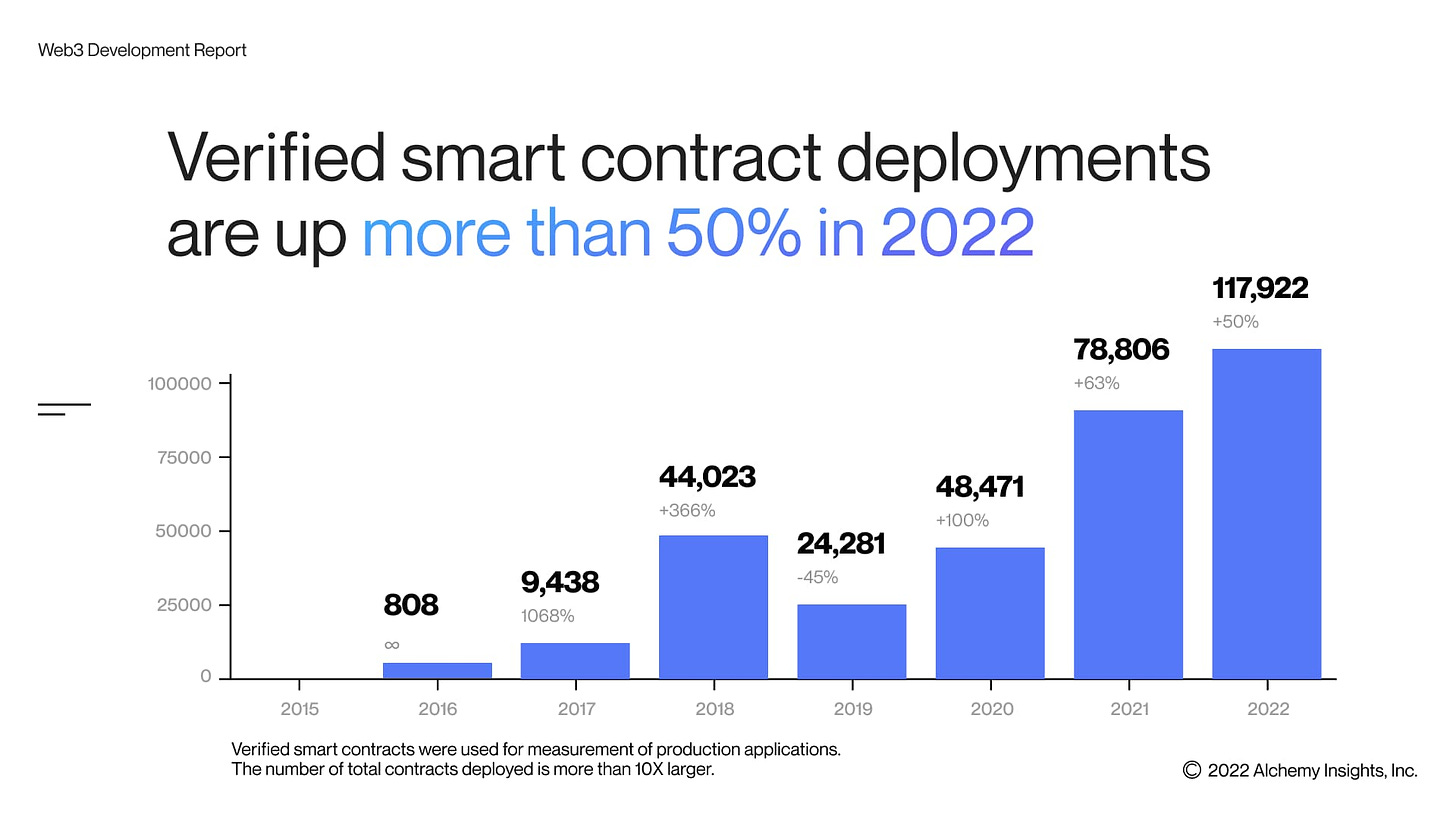

Increase in contracts created for DeFi and NFT indicate healthy developer activity and growth. September = 160% YoY

2016: 808

2017: 9,438 (+1068%)

2018: 44,023 (+366%)

2019: 24,281 (-45%)

2020: 48,471 (+100%)

2021: 78,806 (+63%)

2022: 117,922 (+50%)

More than 12,000 dapps and growing.

12,495 dapps across all blockchains with at least 1 active user in the last 24 hours.

Up 1200% since 2018 when there were only 1,000 active dapps.

Web3 developers are still building useful and lasting products that change the way we connect with each other and the internet.

Developers are more active than ever despite the wildest market conditions.