Meta Investments News (February 2022)

Meta Investment News is a monthly newsletter sent to our investors and supporters.

Why Crypto? Why Now?

In last month's newsletter, we explained that blockchain introduces a trustless, peer-to-peer, decentralized technology that operates without human intervention: 24 hours a day. 7 days a week. 365 days a year. It is open-sourced, publicly verifiable and available to anyone with a simple internet connection anywhere in the world.

The situation unfolding in Eastern Europe, and the direct impact on people throughout the region, highlights the need for a trustless decentralized technology operating without human intervention... available to anyone anywhere in the world.

In addition to images and news about the war, ATM withdrawal limits have been imposed and Europeans struggle to access their cash.

(Click on image above for the National Bank of Ukraine's guidelines).

The National Bank of Ukraine enacted a temporary cash withdrawal limit of 100,000 Ukrainian hryvnia (the national currency) per day, which is the equivalent of USD ~$3,000.

Ukraine’s central bank halted foreign exchange cash withdrawals and said it would fix the official exchange rate as hostilities roiled domestic markets.

Signs of financial panic are not isolated to the Ukraine. Panic spread to the streets of Moscow where lines formed at ATMs owing to fears that the Russian government could limit withdrawals. The Wall Street Journal reported ATM challenges and local + foreign cash restrictions.

In response to the difficulty of sending, receiving, withdrawing... and generally interacting with government-backed cash (i.e. fiat), the Ukraine government issued the following tweet on Feb. 26 announcing their acceptance of donations in cryptocurrency:

(Click on the image above to access their tweet)

In just over a week, more than USD $40M in donations were received from over 85,000 crypto wallets, which is publicly verifiable via the blockchain and accessed through the links below.

(1) bitcoin donations

(2) Ethereum-based donations

(3) Polkadot donations

Put simply:

(i) Cryptocurrencies are not restricted by political borders.

(ii) Cryptocurrencies avoid control and manipulation by central authority.

(iii) Cryptocurrencies are accessible by anyone / anywhere / anytime (with an internet connection - cue Elon Musk).

Bitcoin came into being during the Great Financial Crisis of 2008. It emerged during a period when faith in the banking system was seriously questioned. Bitcoin - and crypto more broadly - continues to grow in adoption and popularity as fiat currencies become increasingly manipulated and devalued. Cryptocurrencies offer a more robust, efficient, open and accessible alternative to a government-owned/operated/controlled fiat system.

It is human nature to question (fear and even dismiss) new, disruptive and transformational technology.

Technologies evolve.

Societies evolve.

We evolve.

We continually witness disparate and archaic financial systems around the world breakdown and abandon the individuals they are meant to support.

We are experiencing a financial evolution in our increasingly native digital world. Blockchain technology offers global opportunities for trustless, peer-to-peer and decentralized commerce operating without human intervention: 24 hours a day. 7 days a week. 365 days a year.

This new and inclusive financial system is available to anyone with an internet connection anywhere in the world.

NFTs 101

NFT is Collins Dictionary’s 2021 word of the year (link to blog announcement). NFTs are enabled by blockchain technology and play a valuable role in our future decentralized internet (i.e. Web3.0).

NFT = Non-Fungible Token

(A) Fungible: a good or commodity whose individual units are interchangeable and each part is indistinguishable from another part.

Example: currency of a particular country

➔ $1 = $1

➔ $100 = $100

➔ 4 x $0.25 = $1

(B) Non-Fungible: unique and non-interchangeable unit. Cannot be easily exchanged for something of equal value.

Examples: art and collectibles because of their unique properties and scarcity:

➔ Mona Lisa within the Louvre

➔ Honus Wagner T206 Baseball Card

(C) Non-Fungible Token (“NFT”): unique digital certificate registered on a blockchain to record ownership of an asset. Uniqueness and ownership is proven via transparent and immutable records that are easily accessible and secured by distributed ledger technology + tokenomics (i.e. cryptocurrency).

In our world of (exponential) technological growth, it intuitively makes sense that digital assets and experiences accrue meaningful value. The associated monetary value is based on utility and supply/demand.

Considering the newness of blockchain technology and the exponential growth of Web3.0, it is understandable that people are skeptical about the monetary value associated with NFTs at this stage.

However, there are discreet and objective metrics available to determine value that include (1) size of online communities; (2) user engagement; (3) growing network effect (Metcalfe’s Law); (4) usability / utility; (5) inherent or associated economics… and more.

2021 was the year NFTs went mainstream and entered our lexicon.

At Meta, we believe that NFTs will eventually represent everyday items and experiences in our natively digital world:

(1) Music

(2) Art

(3) Comics (e.g. PUNKSComic and Huxley Saga)

(4) Concerts

(5) Events

(6) Fan/User Engagement

(7) Loyalty Programs

(8) Teams

(9) In-game Avatars / Items (i.e. Metaverse)

(10) Play-to-Earn Gaming (e.g. Axie Infinity)

(11) Personal Profile Pictures ("PFP" - e.g. Bored Ape Yacht Club)

(12) Collectibles / Marketplaces (e.g. OpenSea)

(13) Collateralization

(14) Online Communities

(15) Legal Agreements (see article below: Florida real estate sale)

(16) —> Things We Have Yet to Imagine <—

(17) *Everything*

*incl. scarce/unique items from physical world*

Article: Florida real estate sale - Someone just bought a Florida home for $653,000 through an NFT sale.

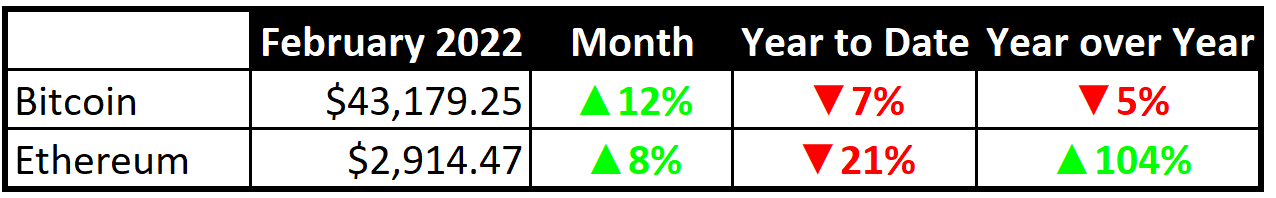

February Cryptocurrency Market Update

Cryptocurrencies are generally viewed as a risky asset class. When equity markets correct, cryptocurrencies typically see a disproportional decline as investors aim to "protect" themselves through defensive cash positions.

The turbulent market in February was adversely impacted by headlines of inflation and the impending (then actual) war in Eastern Europe:

10-year Treasury yield tops 2% for the first time since 2019

"...the benchmark 10-year rate breached the 2% level, after key inflation data showed hotter-than-expected price pressures [of 7.5%] ... the first time that the benchmark rate reached 2% since August 2019."

Russia and Ukraine Conflict

"On 24 February 2022, Russia launched a large-scale invasion of Ukraine, one of its neighbours to the southwest. Early reports declared it the largest conventional warfare operation in Europe since World War II"

Despite the headlines and correction in equity markets, we witnessed a divergence in the price of bitcoin and Ethereum against traditional equities during the month of February:

Bitcoin: up 12%

Ethereum: up 8%

S&P500: down 3%

NASDAQ: down 3%

TSX: 0%

Bitcoin's association with "digital gold" continues to strengthen. It possesses a lot of the positive qualities of money, combines the scarcity and durability of gold in addition to the use, storage and transportability of fiat (even improving on it).

Ethereum is distinctly different than Bitcoin. It is a platform that powers decentralized applications that everyone can use and no one can take down.

We believe that Bitcoin and Ethereum play a prominent role in our digitally native future.

We remain very bullish on the opportunity that blockchain + cryptocurrencies represent, especially at these relatively depressed levels.