Meta Investments News (December 2022)

Meta Investments News is a monthly newsletter sent to our investors and supporters.

Top News/Articles for December 2022

December Cryptocurrency Market Update.

(Discussed Below)MESSARI REPORT: Crypto Theses for 2023.

(Discussed Below)Dapp Industry Report 2022.

(Discussed Below)2023 Crypto Outlook By Prominent Researchers.

(Discussed Below)Howard Marks: Sea Change (available in audio format)

There have been a number of economic cycles in 53 years of Howard Marks’ investment career… he remembers only two sea changes.

We may be in the midst of a third sea change.

1969: equity portfolios focused on “Nifty Fifty”.

Stocks of companies considered the best and fastest-growing. So good that nothing bad could ever happen to them.

“No price too high.”

Would have experienced losses of more than 90% if held the Nifty Fifty from 1969 until 1974.

Historically, investors didn’t think in terms of risk/return.

Modern investing: risk is not avoided but considered relative to return = First Sea Change.

Paul Volcker (Fed chairman in 1979) raised fed funds rate to 20%(!) in 1980 to cut inflation from 13% to 3.2% by the end of 1983.

Volcker ushered in a declining-interest-rate environment lasting four decades = Second Sea Change.

The long-term decline in interest rates began just a few years after the advent of risk/return thinking led to (a) rebirth of optimism among investors; (b) pursuit of profit through aggressive investment vehicles; and (c) incredible four decades for the stock market.

Surprised if 40 years of declining interest rates didn’t play the greatest role within investors’ success over the last 40 years.

With a relatively higher rate environment, investors can now potentially experience solid returns from credit instruments = no longer heavily reliant on riskier investments to achieve overall return targets.

Investment strategies that worked best over a decreasing interest rate environment may not be the ones that outperform in the years ahead = Third Sea Change.

Listen to “Behind the Memo - Sea Change” where Howard discusses the ideas behind Sea Change.

The Crypto Story - Where it came from, What it all means, and Why it still matters..

THE comprehensive overview of digital assets:

Ledgers, Bitcoin, Blockchains.

What Does It Mean? A Store of Value; A Distributed Computer; A Slow Database; Web3; Uncensorable Ledgers; Digital Scarcity.

The Crypto Financial System: Your Keys, Your Coins, Your Hard Drive in a Garbage Dump; Centralized Finance; Stablecoins; Decentralized Finance; Reinventing 2008.

Trust, Money, Community: Trust; Money; Community; Finance.

What We’re Listening To

For Your Innovation with Cathie Wood from Ark Invest: Contextualizing Today’s Economy w/ Jeremy Siegel.

ARK Crypto Brainstorm #01: The Aftermath of FTX

Felix Zulauf Webinar with Arthur Hayes Moderated by Unchained: Macro-economic and geopolitical landscape and the effect on equities, cryptocurrencies, and other markets.

Bloomberg Surveillance: Hawkish Fed Sparks recession fears.

The F*cking Metaverse w/ Matt and John (founders of CryptoPunks): Toying Around w/ Silly “What If”s Can Lead to the Next Big Thing, Including Yuga’s Acquisition of CryptoPunks.

Web3 with a16z crypto: Ben Horowitz and Brian Armstrong on Building and Overcoming the Hard Things.

December Cryptocurrency Market Update.

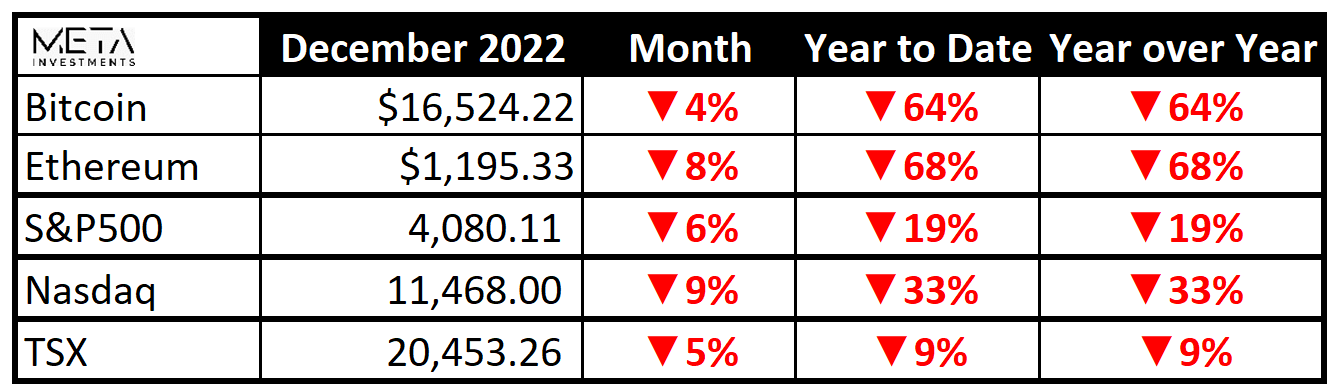

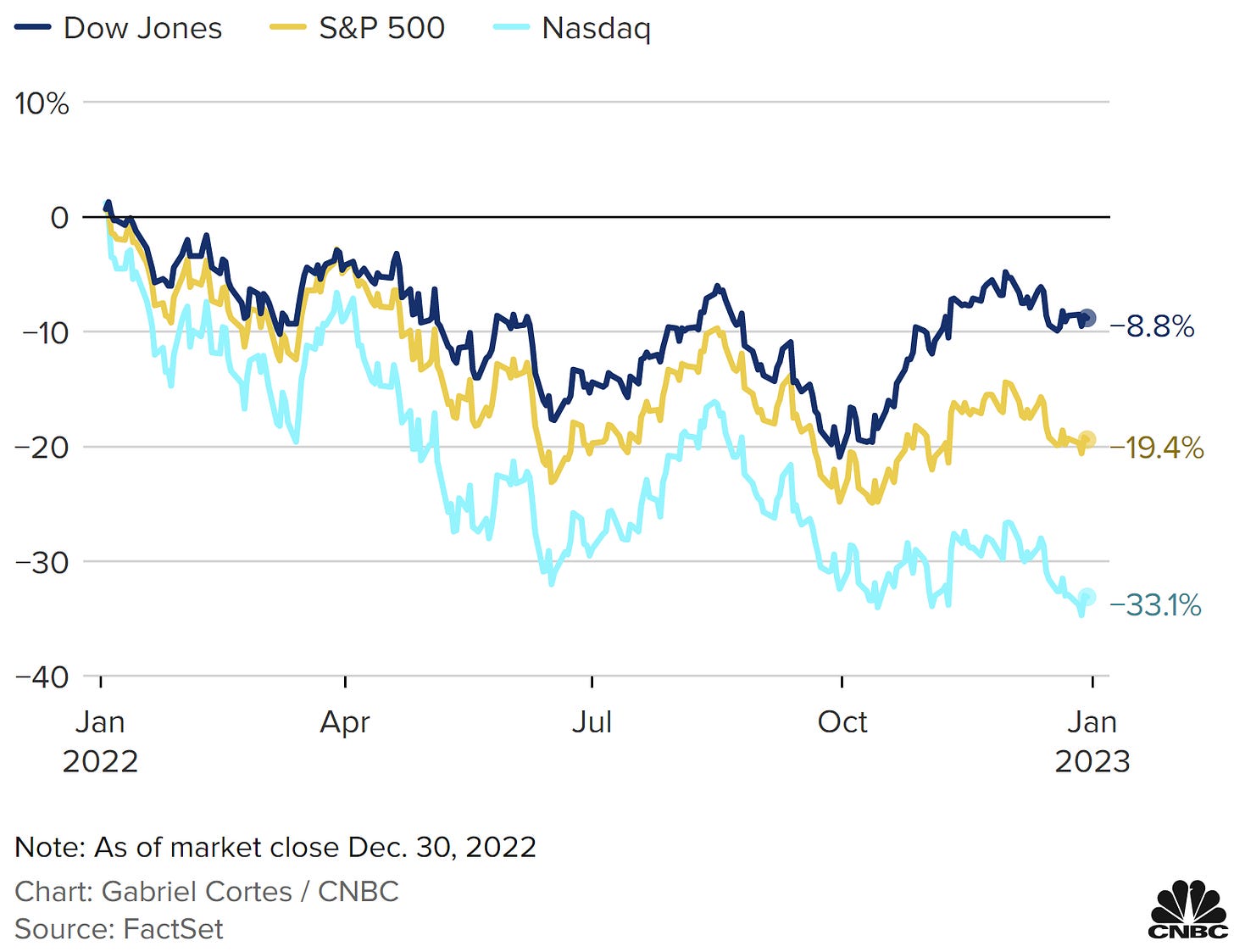

Markets experienced the worst year since 2008.

Nasdaq: down 33%

S&P500: down 19%

TSX: down 9%

Very few professionals (if any) accurately predicted the market’s violent 2022 correction.

S&P 500 estimates compiled by Bloomberg for 2022 ranged from 4,400 to 5,300.

Actual S&P500 performance was 7% below the lowest prediction and 23% below the highest prediction.

Reuters reported that global equities lost $14 trillion in 2022, with many familiar technology names hit hardest:

Apple: down 29% or $835 billion.

Amazon: down 49% or $834 billion.

Alphabet (Google): down 40% or $772 billion.

Mircosoft: down 29% or $735 billion.

Tesla: down 63% or $672 billion.

Meta (Facebook): down 65% or $602 billion.

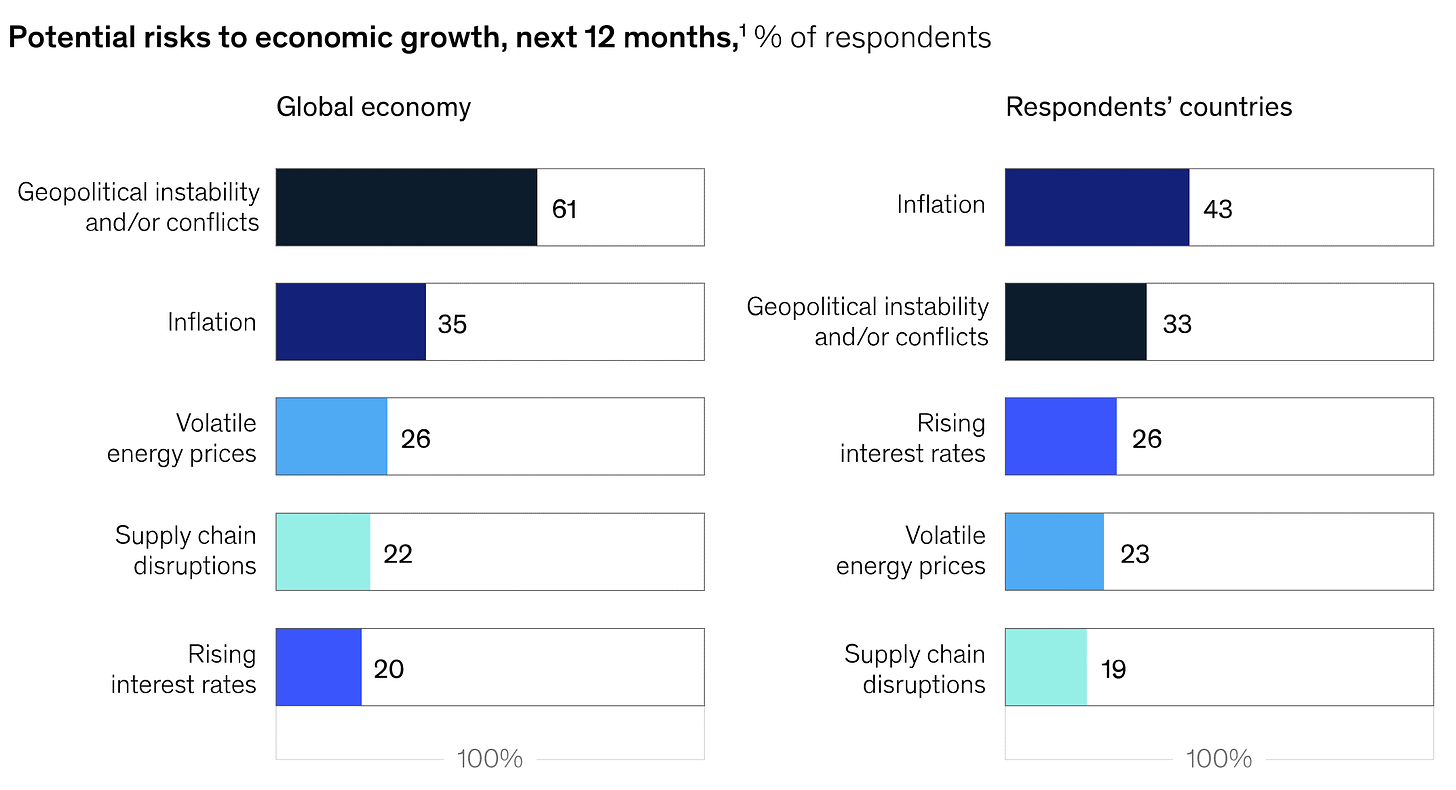

We wrote about the main contributors to the market’s dismal performance in our newsletters throughout the year:

Sticky inflation (around 40 year highs)

Aggressive rate hikes from the US Federal Reserve (fastest rate hikes. ever.)

Geopolitical concerns. (Russia/Ukraine, China)

Volatile energy prices.

Supply chain disruptions.

What are the risks going forward?

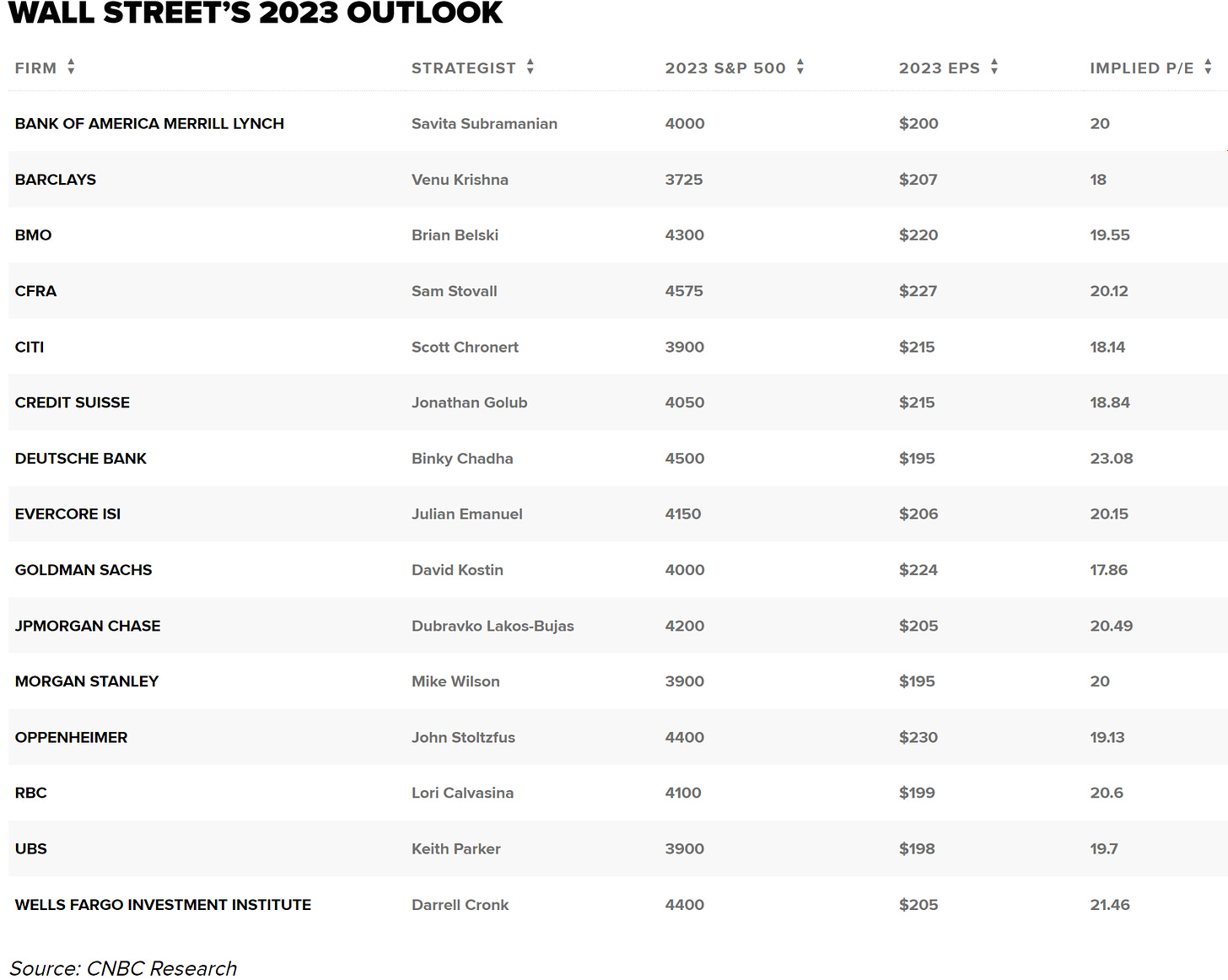

Where do equity markets go from here?

Given the inaccuracy of professional predictions for 2022, it’s safe to say that no one really knows ¯\_(ツ)_/¯.

Below are 2023’s targets for the S&P500 from top strategists via CNBC:

Top target: 4,575 (Sam Stovall, CFRA)

Low target: 3,725 (Venu Krishna, Barclays)

Average: 4,147

Median: 4,100

We’ve also included links to comprehensive market reports:

Goldman Sachs Macro Outlook 2023: This Cycle Is Different

J.P. Morgan Investment Outlook 2023

Morgan Stanley 2023 Investment Outlook

Bank of America Outlook 2023: Back to the (new) future

Barclays Living with shock and awe.

NatWest The Year Ahead 2023

Citi Roadmap to recovery: Portfolios to anticipate opportunities

Credit Suisse A fundamental reset

BNP Paribas INVESTING IN AN AGE OF TRANSFORMATION

Deutsche Bank Resilience versus recession

Apollo Global Management, Inc. 2023 Economic and Capital Markets Outlook

Wells Fargo Recession, recovery, and rebound

BNY Mellon LOOKING THROUGH TO RECOVERY

Fidelity International Navigating the polycrisis

Cryptocurrencies were also hit hard in 2022.

According to CoinMarketCap, the crypto market fell 64% from $2.2 trillion to $795 billion.

Most cryptocurrencies - especially Bitcoin and Ethereuem - are very liquid. They can be traded or liquidated 24/7/365 (including evenings, weekends and holidays).

Liquid investments are first to sell when investors run for safety.

Why?

It’s nearly impossible to demand funds from private company investments until a liquidity event.

It’s nearly impossible to demand funds from private debt until maturity.

You can only sell public equities in North America between 9:30am-4pm EST from Monday to Friday (closed on holidays).

Solution:One can exchange Bitcoin or Ethereum (or many other cryptocurrencies) to fiat dollars at any time on any day.

People desperate for quick liquidity can extract their money from crypto markets on evenings and weekends, unlike traditional capital markets.

Panicked crypto investors / traders can sell based on media reports of (1) sticky inflation; (2) aggressive rate hikes from the US Federal Reserve; (3) geopolitical concerns about Russia/Ukraine or China; (4) volatile energy prices; or even (5) supply chain disruptions.

The same macro factors effecting equities influence crypto traders.

However, Crypto did not disappear in 2022 despite the many “existential” threats:

Bitcoin down 64%.

Ethereum down 68%.

TerraLuna $60 billion collapse.

FTX $30 billion equity collapse.

Three Arrows Capital $20 billion collapse.

BlockFi $5 billion equity collapse.

Celsius $3 billion equity collapse.

The combined equity value lost by investors from these big stories in 2022 was far less than the equity lost by investors in a single publicly listed Big Tech company.

It’s impossible to predict where prices will go in the near-to-midterm for cryptocurrencies. 🤔

Meta Investments maintains that Bitcoin and Ethereum will play a prominent role in our increasingly digitally native future.

We remain very bullish on the investment opportunity that blockchain + cryptocurrencies represent, especially at these price levels.

MESSARI REPORT: Crypto Theses for 2023

It’s fair to say Messari’s December 2021 prediction for 2022 was spot on:

Things will get worse before they get better in the “real” world.

Inflation will remain above 5% throughout 2022 (70% confidence), while late year interest rate hikes stall the stock market’s momentum and hurt growth stocks (60% confidence the S&P dips next year)...

A lot of people lost money in 2022, especially in crypto.

Some poorly managed companies went bankrupt.

Many of the surviving companies are well capitalized + shipping product.

Now we’re left with true believers and long-term builders – fewer gamblers, scammers and “tourists”:

Need a globally accepted asset that you can store in your head “just in case” you need to emigrate from a failing country = Bitcoin.

A platform that routes around Big Tech censors = Ethereum (and a multitude of emerging Layer-1 protocols).

Can’t access credit = Decentralized Finance (“DeFi”).

Hate 30-50% take rates for artists = Non-Fungible Token (“NFT”).

Trying to fund research or set up a new organization structure = Decentralized Autonomous Organization (“DAO”).

Like most areas in tech, crypto can be great or it can be abused. It all depends on the specific product, the ethos of the builders, and the rollout strategy.

Crypto is (Still) Inevitable

We’ve made significant progress in the build-out of bitcoin, stablecoins, distributed computing, blockchain scalability, decentralized financial primitives (DEX, lending, asset issuance), and governance structures.These innovations cannot be uninvented.

Trends in Digital Asset Centralized Finance:

This year was a sh*tshow for centralized crypto financial services (“CeFi”).

FTX spectacular implosion.

Coinbase - largest public crypto company - stock decline 80%

Western crypto infrastructure giants laid off hundreds of employees.

Crypto lenders born in 2018-2020 are pretty much all dead, or mostly dead.

Alameda.

Babel Finance.

Blockchain.com.

BlockFi.

Celsius.

FTX.

Genesis Capital.

Jump Capital.

Three Arrows Capital.

Voyager.

Sustainable infrastructure is being built amidst the wreckage:

Custody, Security, Stability.

Cloud Infrastructure and Developer Tools.

On-Chain Forensics.

Tax & Compliance.

Research & Data Upgrades.

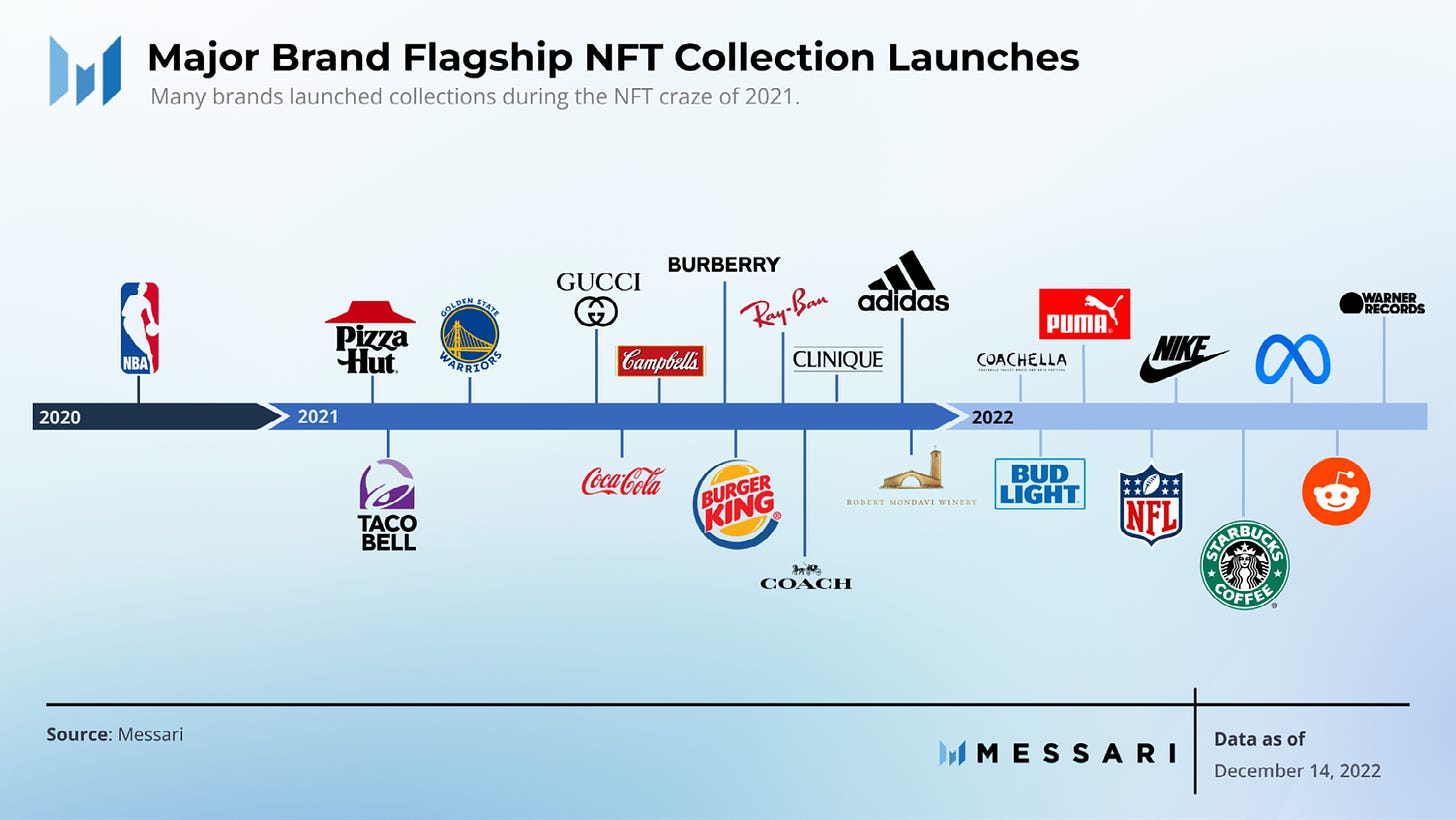

NFTs

NFTs reached euphoric heights in 2021. The hangover this year has been equally painful.

NFTs proved to be big business for big brands last year.

Luxury brands (Gucci, Dolce & Gabbana).

Professional sports leagues (NBA Top Shots).

Food and beverage companies (Starbucks).

we continue to see strong moves from legacy brands and non-crypto tech companies looking to integrate NFTs into their platforms.

Blockchain Gaming

Web3 gaming is all about giving players ownership of their in-game digital items and using tokens to create in-game economies (and potentially, game governance).

Players with a stake in the game they’re playing, whether through in-game items or quasi-equity (tokens), will feel more invested in the game’s success and spend more time and money playing.

If you hit critical mass amongst players, they’ll want to buy and sell items (NFTs), and an in-game economy can emerge that shifts the traditional

gaming business model.

Instead of games extracting value from players via Downloadable Content (DLC) and micro-transactions, game creators can make money as marketplace operators (transaction fees).

Users are incentivized to buy or earn top game items (the Play-to-Earn (“P2E”) model popularized by Axie Infinity).

For more, we recommend reading Messari’s Crypto Theses 2023.

Alternatively, you can listen to the author (Ryan Selkis) discuss it on the Bankless podcast.

Dapp Industry Report 2022

The blockchain industry continues to deliver many incredible technological achievements.

Institutional digital asset adoption continues to occur at a rapid pace: Disney, Starbucks, Adidas, Nike + many other household brands embracing blockchain.

Large financial institutions continue to show interest in the sector:

Fidelity launched a crypto service for investors.

BlackRock partnered with Coinbase to give its institutional clients access to crypto.

Goldman Sachs is creating a crypto data service.

One of the biggest events in recent crypto history occurred this year with Ethereum transitioning from proof-of-work (PoW) to proof-of-stake (PoS), reducing Ethereum’s energy usage by an impressive 99.9% (discussed in our September newsletter).

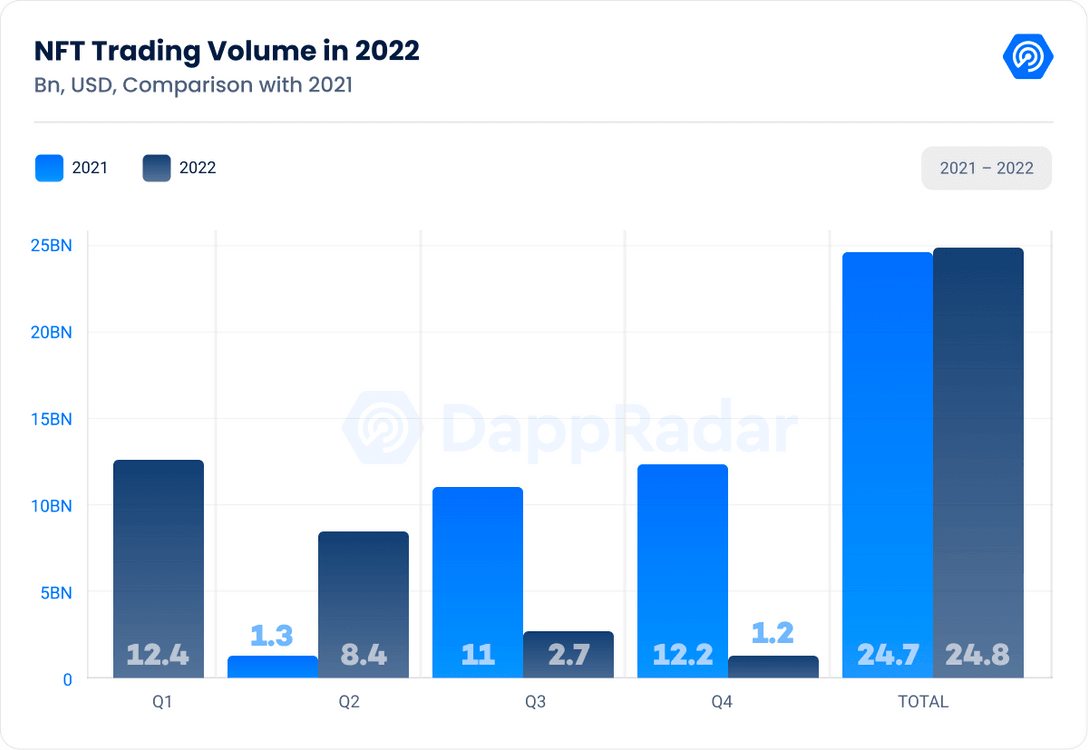

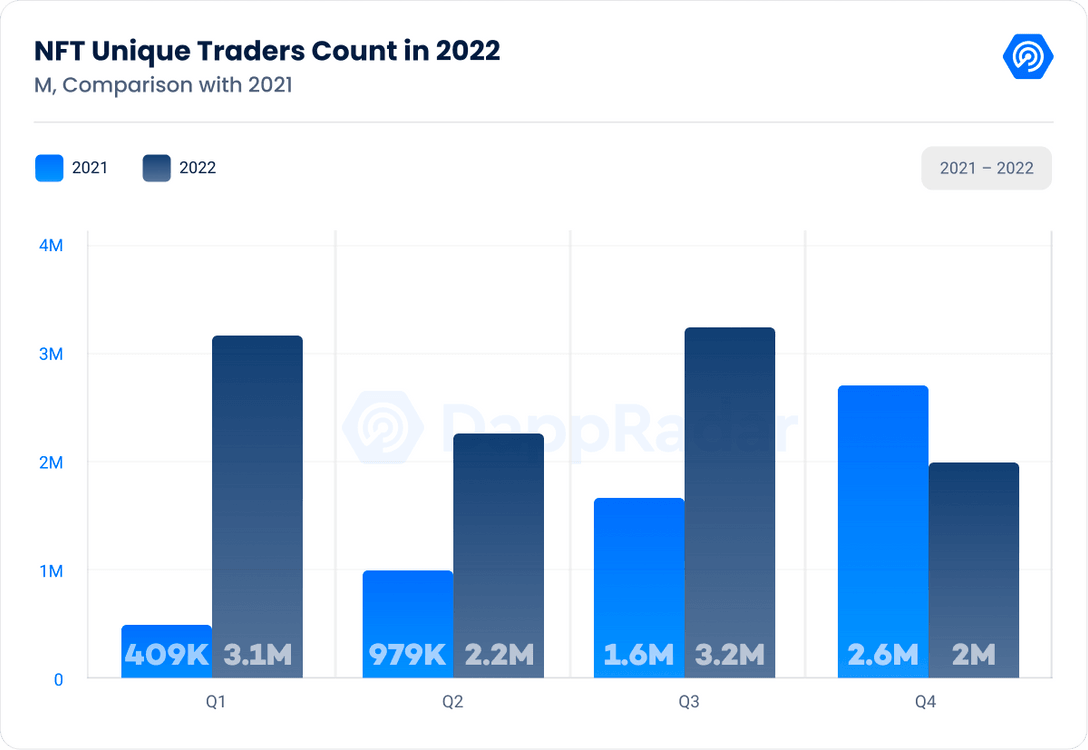

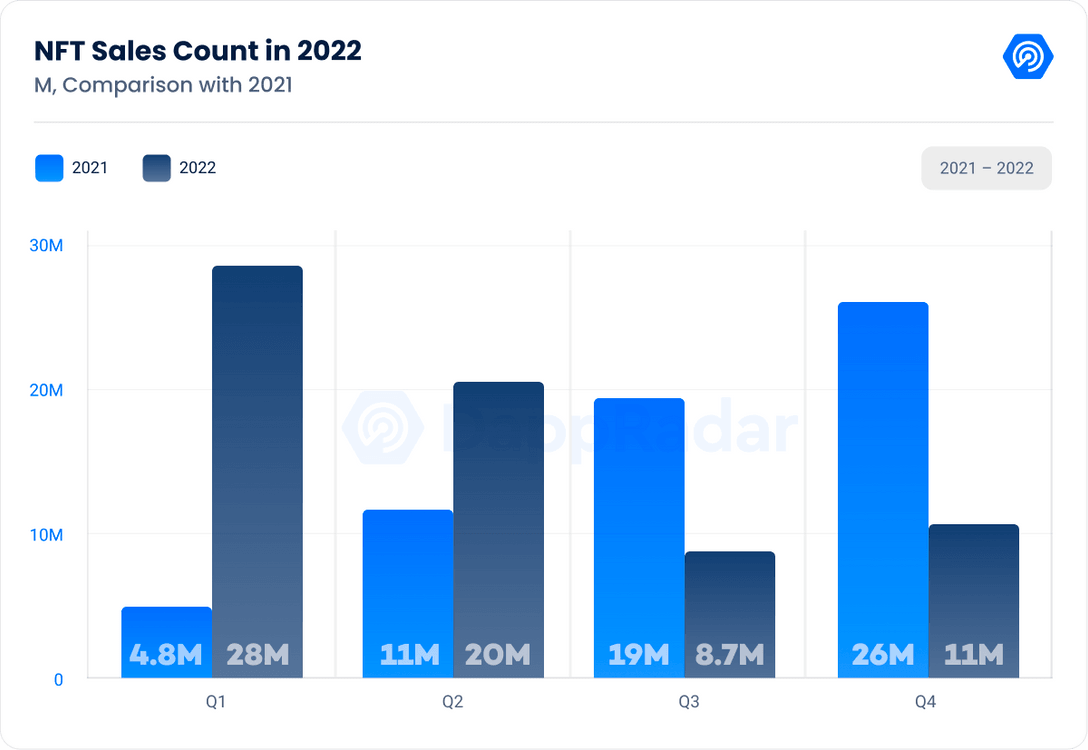

On-chain metrics for the NFT market were positive:

Trading volume increased in 2022 over 2021 (by 0.41%).

Number of unique traders count increased by 876.89% compared to the previous year, reaching 10.6 million.

Sales count reached 68.35 million for an increase of 10.16% over the prior year.

In 2022, there were 312 crypto attacks, resulting in losses of $48.74 billion, the highest for any year :(

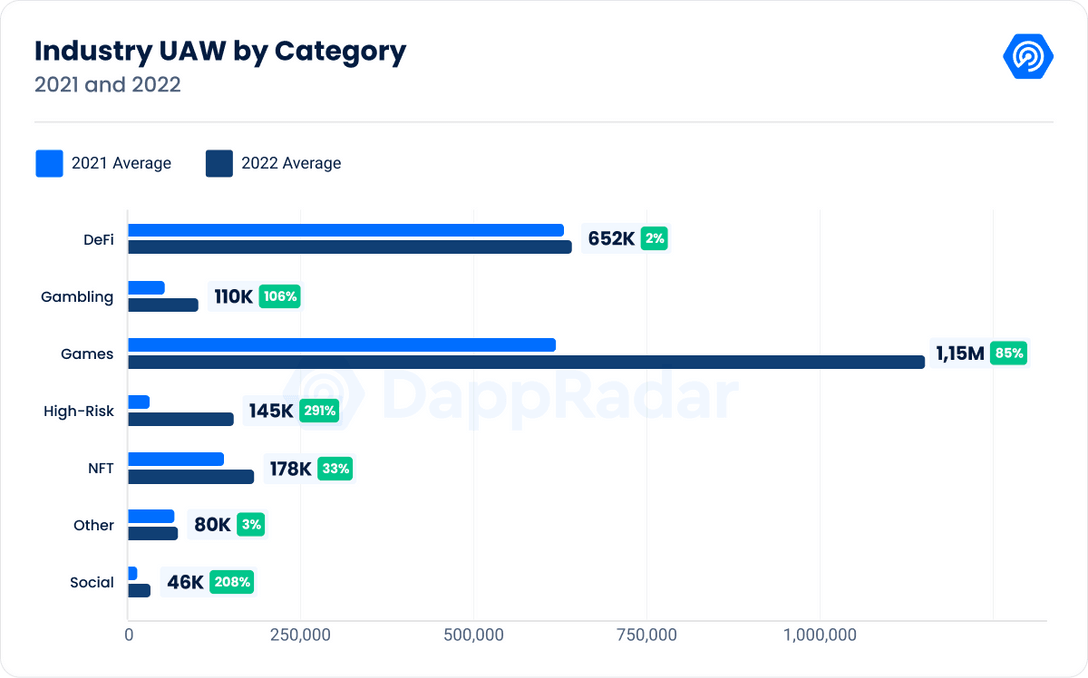

Gaming remain the most popular category of blockchain-based applications, dominating the industry.

In 2021, games had an average of 622,620 daily unique active wallets (“dUAW”). This number grew by 85% in 2022 to 1,152,255 dUAW on average.

The migration of traditional game developers to the blockchain has begun, bringing their expertise and potentially disrupting the traditional gaming market.

The potential for true digital ownership and scarcity through the use of NFTs adds appeal and new mechanics, which will pave the way for innovative game design.

The future of blockchain gaming looks bright, with the market maturing and a shift towards more engaging and fun content. The industry is well-positioned for future growth and mass adoption.

Blockchain Regulation: it is likely that there will continue to be a regulatory focus on improving the transparency and accountability of blockchain-based systems.

The regulatory landscape in the blockchain industry is complex and constantly evolving.

Major regulations in 2022 aimed to improve the transparency and accountability of blockchain-based systems, and it is likely that this will continue to be a key focus in the future.

2023 Crypto Outlook By Prominent Researchers

It’s impossible to predict where prices will go in the near-to-midterm for cryptocurrencies. 🤔

There are a number of themes/predictions that researchers are looking forward to in 2023:

New interfaces & UX: increase usability and reduce friction when onboarding to blockchain or interacting with decentralized applications (dApps).

Mobile: Better wallets to manage digital assets, better blockchain browsers to increase accessibility to dApps.

Scaling: Adoption of Layer 2s (Optimism, Arbitrum and Polygon) and scaling solutions (e.g. ZK-Rollups) so users can forget about transaction fees.

Regulatory: Clarity on IP, classification, licensing of web3 assets, and classification of NFTs (e.g. securities). G20 governments want to create a unified cryptocurrency policy.

Please enjoy the following market reports by a number of notable research firms in the space:

Coinbase 2023 Market Outlook

Pantera Capital 2023 Predictions

Arca Funds 2023 Digital Asset Industry Outlook

New Order DAO 2023 Crypto Thesis

Crypto.com 2022 Year Review & 2023 Year Ahead

Huobi Research Global Crypto Industry Overview and Trends

Binance Will 2023 be better than 2022?

Delphi Digital The Year Ahead for Markets

Cointelegraph 10 predictions for crypto in 2023

CoinDesk Crypto Markets Outlook for 2023

Forbes Crypto Outlook For 2023

Saxo Bank What will crypto bring in 2023?

Fidelity 2023 crypto outlook

Meta Investments maintains that Bitcoin and Ethereum will play a prominent role in our increasingly digitally native future.

We remain very bullish on the investment opportunity that blockchain + cryptocurrencies represent, especially at these price levels.