Meta Investments News (April 2022)

Meta Investments News is a monthly newsletter sent to our investors and supporters.

Top News/Articles for April 2022

Wall Street Firms Make Crypto Push to Catch Up With ‘Cool Kids’

(Discussed Below)The Art Of Tokenization: How A Picasso Painted Itself Onto The Blockchain

(Discussed Below)

Fidelity to Let Workers Save 20% of Retirement in Bitcoin

Fidelity is America’s largest provider of company-sponsored 401(k) savings accounts.

Received growing interest from plan sponsors to offer Bitcoin / digital assets in retirement plan.

Enable allocation up to 20% of their employees' funds in Bitcoin.

NFT Collections Worth Knowing About

CryptoPunks: often cited as the first NFT set and definitely first to gain significant cultural traction.

Bored Ape Yacht Club: most recognized NFT project and endorsed by many celebrities (Justin Bieber, Madonna, Steph Curry, Jimmy Fallon…).

CyberKongz: often cited as the first NFT collection with "utility" = art that does more than just be art.

Azuki: embodies anime aesthetic with global appeal.

World of Women: created exclusively by women and designed to encourage a more diverse NFT community.

Doodles: pastel colors and squiggly design aesthetic that have become iconic in NFT circles.

VeeFriends: created by one of the industry's biggest influencers.

Clone X: created by Japanese artist Takashi Murakami (2.5M Instagram followers) in collaboration with Nike's RTFKT. Second biggest anime-style collection behind Azuki and the most popular 3D NFT collection.

What We’re Listening To:

Empire w/ Travis Kling: Bull Case for ETH 2.0 Merge

Lex Fridman w/ Michael Saylor: Bitcoin, Inflation, and the Future of Money

Bankless w/ Dan Morehead: The Stagflation Mega-Trade

Time Ferriss w/ Balaji Srinivasan: The Future of Bitcoin and Ethereum, How to Become Noncancelable, the Path to Personal Freedom and Wealth in a New World, the Changing Landscape of Warfare, and More

Wall Street Firms Make Crypto Push to Catch Up With ‘Cool Kids’.

Meaningful moves by financial heavyweights underscore how far Wall Street firms have come in accepting cryptocurrencies.

Jefferies Financial Group: expanding banking services for crypto clients.

BlackRock Inc.: investing in a cryptocurrencies that pegs the USD.

Goldman Sachs: ramping up crypto trading.

Executives at banks + money managers were previously some of the industry’s most harshest critics until soaring prices and a flood of investor money drove home the point that staying on the sidelines meant missing out.

Institutional investors traded $1.14 trillion of cryptocurrencies on Coinbase (largest U.S. crypto exchange) last year. This represents a 9x year-over-year increase.

Beyond wealth management, trading and advisory, a next step for banks could be wholesale lending to crypto firms. This would entail lending to crypto companies that provide virtual currencies as collateral.

Wall Street is also trying to retain talent that’s leaving for the crypto industry, lured by potentially richer rewards, flexible work hours/location and front-row seats to innovation.

Many crypto-specific investment funds have raised material money over the past year. This money will be invested in projects that continue to develop and elevate the ecosystem… at an exponential pace:

Paradigm: $2.5B (2021)

Andreesen Horowitz: $2.2B (2021)

FTX Ventures: $2B (2022)

Haun Ventures: $1.5B (2022)

Polychain Capital: $300M + $400M (2020/2021)

Sequoia: $600M (2022)

Bain Capital: $530M (2022)

Multicoin Capital: $100M + $250M (2021)

Given the amount of people, capital and energy focused across the crypto industry, it stands to reason that the technology is real and here to stay.

Meta Investments continues to deepen and strengthen our relationships across the entire blockchain community. We are committed to investing + participating in this transformative technology.

The Art Of Tokenization: How A Picasso Painted Itself Onto The Blockchain.

Pablo Picasso was known for experimenting with new creative styles and pushing the boundaries of what society would recognize as aesthetic beauty.

Five decades after the artist’s death, the world’s first regulated digital asset bank (Sygnum) has pushed the boundaries of Picasso’s paintings.

Last year, the Switzerland-based crypto bank made history by moving the legal ownership rights of Picasso’s 1964 masterpiece Fillette au béret onto the blockchain.

It digitized Picasso’s painting and fractionalized it into 4,000 security tokens, which were sold to more than 50 investors at 1,000 Swiss francs ($1,040) apiece.

Courts recognize these digital tokens on an immutable blockchain as legal ownership and legal units of the painting.

Owners of Fillette au béret can log onto Sygnum’s trading platform (SygnEx), and list their tokens for sale whenever they feel like it.

It’s not just collectors who stand to benefit from the technology.

In addition to the practical advantages of ledger-based securities, it’s important to recognize how fractional investments can democratize and catalyze market access beyond art.

“In the end, what we’re trying to provide is broader access to hard-to-access and/or illiquid assets”

Sygnum outlines four pillars of asset classes considered to be candidates for fractional tokenization:

Arts and Collectibles;

Real Estate;

Mid-Cap (Companies); and

Venture Capital (VC).

“We see ourselves at the very forefront of tokenization: pushing the boundaries and challenging the status quo.”

“And we’re convinced that its inflection point is yet to come.”

*Meta Investments is a proud investor in Sygnum after co-leading the Company’s recent Series B round of financing.

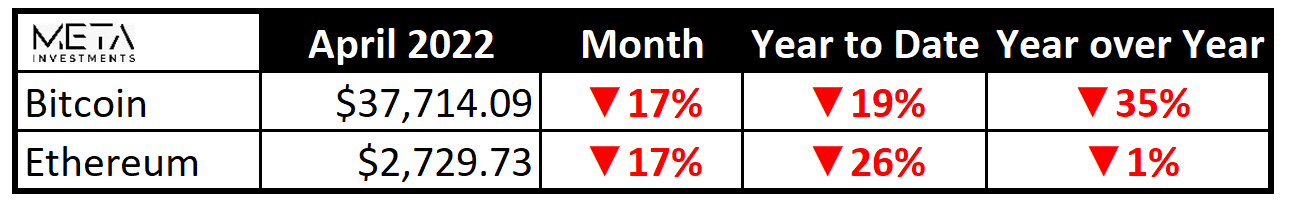

April Cryptocurrency Market Update

Cryptocurrencies are generally viewed as a risky asset class. When equity markets correct, cryptocurrencies typically see deeper declines as investors aim to "protect" themselves through defensive cash positions.

The Nasdaq had its worst month in April dating back to 2008. The S&P 500 also experienced its biggest monthly decline since the start of the pandemic.

Wall Street Is Battered by Rising Fear About the Economy

“…many investors are coming to the same conclusion: The economy is about to take a hit, and everywhere they look, they see trouble ahead.”

“…several measures show that [consumer] confidence is eroding quickly, and economists expect demand to slow as people face high prices and rising borrowing costs at the same time.”

“The outlook for the economy, the effects of the Ukraine invasion, the lockdowns in China and exactly how fast the Fed will raise interest rates are still not clear. Markets are likely to stay volatile until they are.”

Interest Rates are rapidly rising across North America. As we stated last month, equities are (generally) priced by discounting expected future cash flows to time zero (today) using a discount rate. An increase in interest rates results in an increase in the discount rate used to present value future cash flows. A higher discount rate leads to a lower present value of future cash flows. Lower present value of cash flows divided by same shares outstanding = lower price per share.

Bank of Canada increases policy interest rate by 50 basis points

“…increased its target for the overnight rate to 1%.”

“…will begin quantitative tightening (QT), effective April 25.”

“CPI inflation is now expected to average almost 6% in the first half of 2022…timing and pace of further increases in the policy rate will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving the 2% inflation target.”

Fed to raise rates aggressively in coming months

“Federal Reserve is expected to deliver two back-to-back half-point interest rate hikes in May and June to tackle runaway inflation.”

“Moving so quickly with interest rates, especially in an economy that has become used to very low borrowing costs for many years, comes with risks.”

“one-in-four chance of a U.S. recession in the coming year, rising to 40% over the next 24 months. The bond market is already showing signs of recession concerns.”

[hindsight reveals the Fed raised rates 0.50%, which is the largest increase in 2 decades]

Prices may fluctuate wildly in the short term and every asset may be materially impacted during a market sell-off (some more than others):

Bitcoin: down 17%

Ethereum: down 17%

S&P500: down 9%

NASDAQ: down 13%

TSX: down 5%

Emotions cloud one’s rational thought process in the short-term. When you have the greatest urge to sell, is usually when one should be buying.

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine”

- Benjamin Graham

Meta Investments maintains that Bitcoin and Ethereum will play a prominent role in our increasingly digitally native future.

We remain very bullish on the opportunity that blockchain + cryptocurrencies represent, especially at these price levels.